M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The peer-to-peer (P2P) lending landscape in India is experiencing a remarkable transformation, opening doors to exciting opportunities.

Industry estimates show that P2P lending platforms have seen their assets under management (AUM) skyrocket, projected to reach INR 10,000 crore by 2025. This growth, driven by the last decade’s surge, attracts borrowers seeking quick, paperless loans and lenders chasing returns compared to traditional investments.

However, this rapid rise has brought new challenges, prompting closer scrutiny and action.

As the P2P lending sector expanded, concerns began to surface. To regulate this fast-evolving industry, the Reserve Bank of India (RBI) established a comprehensive framework in 2017, aiming to bring clarity and stability.

Yet, despite these efforts, approaches such as promising guaranteed returns and bundling unrelated products like insurance increased considerations for participants.

Recognizing the need for stronger action, the RBI introduced stricter guidelines on August 16, 2024, to tackle these issues head-on and redefine the industry’s future.

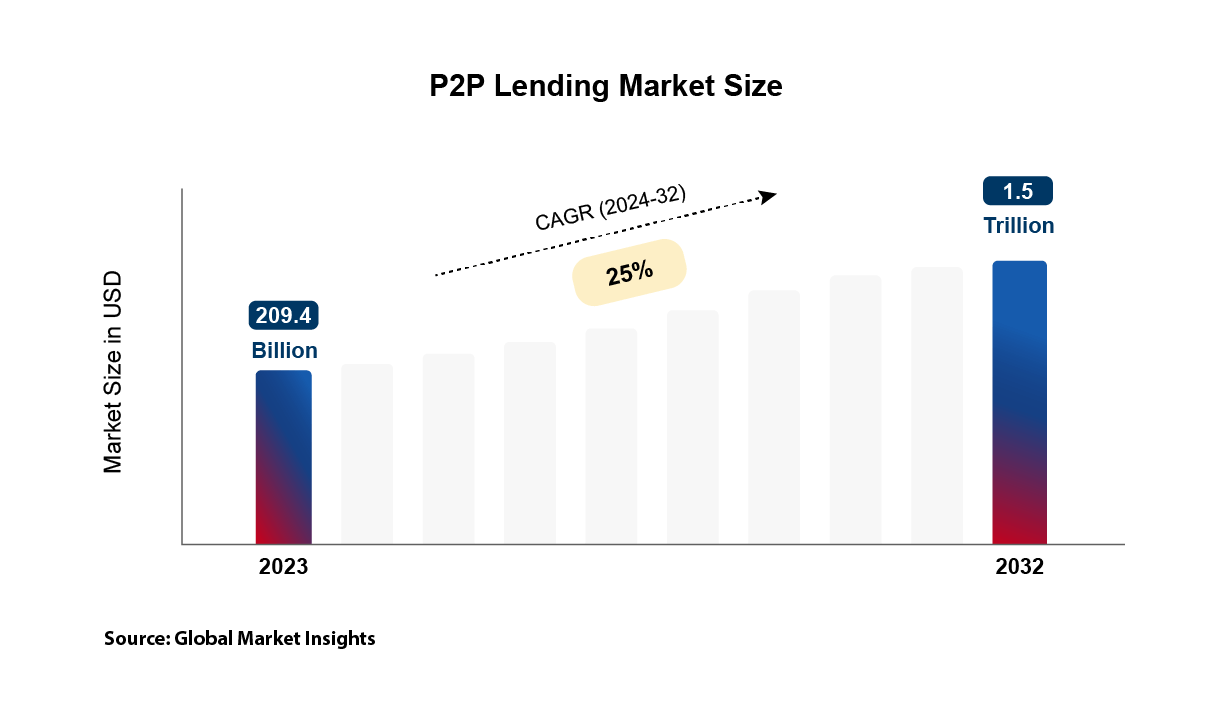

While these reforms may initially moderate liquidity and transaction pace, they establish a robust foundation for a secure, transparent P2P lending ecosystem poised to unlock a $1.5T future. With the RBI’s focus on stability and trust, the stage is set for sustainable growth, attracting savvy investors and empowering borrowers alike.

At the Inclusive FinTech Forum 2025, co-founder Madhusudanan R joined a closed-door discussion with President Paul Kagame of Rwanda, Benjamin Fernandes (CEO, NALA), Marlon Chigwende (Founder, Admaius Capital Partners), Parag Bhise (CEO, Nucleus Software), and Prajit Nanu (CEO, Nium). The focus was on Rwanda's dynamic fintech landscape and the collaborative opportunities created by its progressive business environment. We are excited about the innovation and growth potential in Rwanda. advancements in Fintech innovation.

During our 3-day campus drive in Vizag, we engaged with over 550 students from prestigious institutions, including Vignan's Institute of Information Technology, Sri Vasavi Engineering College, GITAM, MVGR College of Engineering, and Aditya Institute of Technology and Management, showcasing their impressive skills and enthusiasm.