M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Did you know?

In 2024, the top 10 AML violations resulted in $3.1 billion in fines. This staggering figure highlights the scale of financial crime and the importance of stringent AML measures

With such economic crimes becoming more sophisticated, the evolution of AML laws continues to be a crucial defense in safeguarding the integrity of the global financial system.

With an estimated $1.6 trillion laundered annually, 2.7% of global GDP, the urgency for strong Anti-Money Laundering (AML) frameworks has never been greater. The global fight against financial crime is shifting toward a unified, tech-savvy, and risk-focused approach, pushing financial institutions to stay ahead of threats.

Europe’s AML Authority (AMLA), active since 2024, unifies EU rules with the 6th AML Directive (6AMLD), enforcing tougher penalties and ownership transparency. North America modernizes—U.S. FinCEN uses AI for real-time monitoring and crypto oversight, while UAE will hold high-level talks with the EU to support global efforts against money laundering and financial crimes. In APAC, Singapore and Hong Kong enforce strict KYC for virtual assets, while Africa boosts Pan-African teamwork to align with FATF. India and Southeast Asia curb trade-based laundering with cross-border controls.

Financial institutions are increasingly adopting AI, automation, and predictive analytics for AML compliance, and this trend is expected to accelerate. By 2025, these technologies are likely to be standard for enhancing transaction monitoring, identifying patterns, and reducing false positives in suspicious activity detection.

New updates signal progress:

As AML laws evolve, they strengthen global financial security, creating a safer, more transparent economic landscape. The fight against money laundering is not just a regulatory obligation; it is a commitment to ensuring a safer, more transparent world.

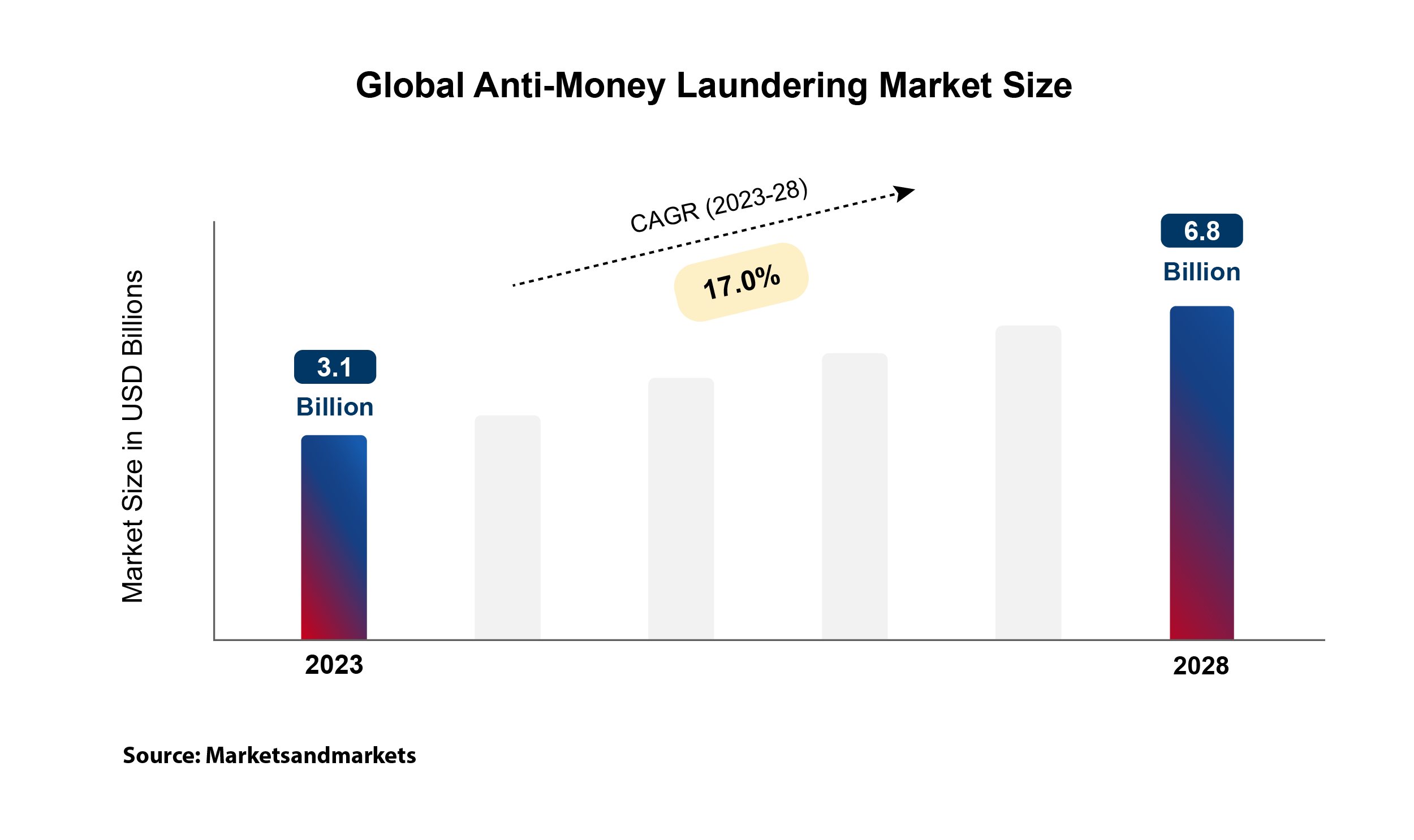

Global AML market is set to double by 2028!

Shivam Maheshwari, Vice President of Engineering, was honored at ET Now’s Top 100 BFSI Tech Leaders Awards for pioneering transformative technology that is redefining the future of BFSI.

Vamsi Kotte, Senior Vice President of Business Development, partook in a keynote session at MOSIP Connect 2025 in Manila, Philippines. He shared insights on "M2P's Experience in Implementing National ID Projects at Large Scale" and our learnings from working with five state governments and 100 use cases, engaging with delegates from various countries.