M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Biometric technology is transforming the fintech industry by boosting security, efficiency, and personalization. In 2024, a staggering 82% of all fraud was linked to impersonation. Highlighting this trend, a March 2025 report revealed that 79% of financial institutions are either implementing or planning to adopt biometric authentication solutions by 2026, marking a significant move towards biological identity as the cornerstone of secure finance. Yet, the most groundbreaking applications of biometrics remain on the horizon, waiting to redefine the financial services landscape.

Let’s explore these emerging opportunities and chart a strategic path to fintech’s next frontier:

By leveraging behavioral and physiological biometrics, fintech platforms can analyze stress, emotions, or spending patterns to offer customized financial solutions, boosting user engagement through advanced AI integration

Biometrics enhances financial literacy platforms by monitoring user engagement and personalizing learning experiences. For instance, facial recognition monitors attention during courses, while wearable devices adjust game complexity based on heart rate, enhancing learning outcomes.

Supply chain financing is being fortified by innovative authentication methods that verify supplier identities and prevent invoice fraud. Through the use of facial or fingerprint scans, the receipt of goods can be confirmed, allowing for automated payments—a specialized yet emerging application in fintech that promises to streamline financial transactions within supply chains.

Biometrics boost trust in crowdfunding platforms by verifying campaign creators and backers through facial or voice recognition. Behavioral biometrics also flag suspicious donation patterns, reducing fraud risks.

Insurance processes are being streamlined with advanced biometric technologies like voice-activated policy activation, health claim verification using wearables, and fraud detection through voice analysis during claims calls. These innovations, while still experimental, showcase significant potential to enhance efficiency and accuracy in the insurance sector, paving the way for a more seamless customer experience.

Biometrics provide unmatched security by leveraging unique biological traits that are nearly impossible to replicate. For example, facial recognition boasts an accuracy rate of up to 99.97%, far surpassing traditional methods. Additionally, AI-driven biometrics continuously evolve to counter emerging fraud tactics, ensuring robust protection for users and institutions alike.

As fintech integrates biometric technology, it significantly improves security while also boosting operational efficiency and enabling personalized experiences for users. With innovations like AI-powered fraud detection and seamless identity verification, biometrics are set to revolutionize the future of financial services.

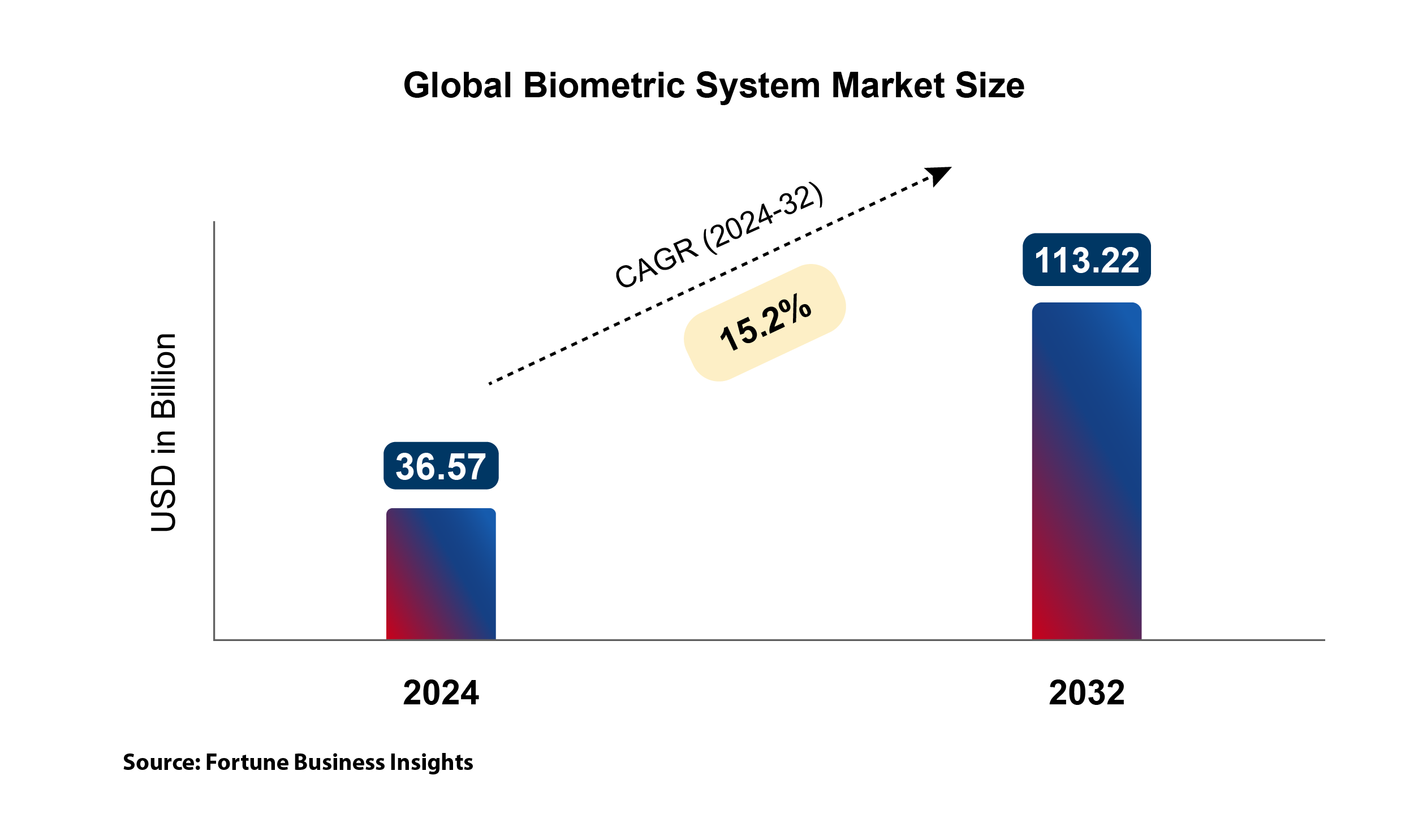

By 2032, the biometric system market is poised to reach USD 113.22 billion.