M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Imagine a bustling marketplace where every transaction, whether it’s grabbing a coffee, hailing a cab, or closing a business deal—happens instantly with just a tap or scan. In this new era, the sound of coins and paper has faded, replaced by seamless digital flows connecting millions across cities and borders.

This isn’t a distant vision; it’s the reality of 2025. Digital payment gateway market is projected to reach USD 712.14 billion, as digital commerce accelerates and payment gateways become the silent engines powering every swipe, click, and tap.

No longer just intermediaries, payment gateways are now the architects of modern financial experiences—driving inclusion, trust, and business growth. Here’s what’s shaping the next phase of digital payment gateways in 2025:

Consumers expect flexibility at checkout. Payment gateways are meeting this demand by supporting UPI, digital wallets, contactless payments, and Buy Now, Pay Later (BNPL) helping merchants boost conversions up to 30%. Cross-border solutions and tokenization are opening new doors for global commerce and secure, one-click payments, while smart routing and AI-powered analytics further optimize the payment experience.

As India handles more than 18 billion UPI transactions each month, scalability is crucial. Leading providers are deploying cloud-native architectures and edge computing to handle surges of 10,000+ transactions per second, ensuring reliability even during peak sales events.

As digital transactions rise, so do fraud risks. Payment gateways are harnessing AI to analyze transaction patterns in real time, flagging anomalies, and preventing fraud before it happens. Generative AI has tripled fraud detection rates, while behavioral biometrics and device fingerprinting add invisible layers of security, resulting in a 40% drop-in fraudulent activity for businesses leveraging these tools.

Contactless and QR-based payments are now the norm, with NFC and tap-to-pay features dominating both online and offline transactions. Tap & Pay and UPI Lite are simplifying microtransactions for unparalleled ease and accessibility.

Central Bank Digital Currencies (CBDCs) like the e-rupee are redefining digital payments with enhanced security and offline capabilities. Seamless currency conversion, blockchain settlements, and multi-currency acceptance are empowering merchants to go global with ease.

As payment systems become more intelligent and integrated, gateways are emerging as key enablers of business transformation. Their continued evolution will define the next chapter of digital commerce—one that’s faster, safer, and more connected than ever before.

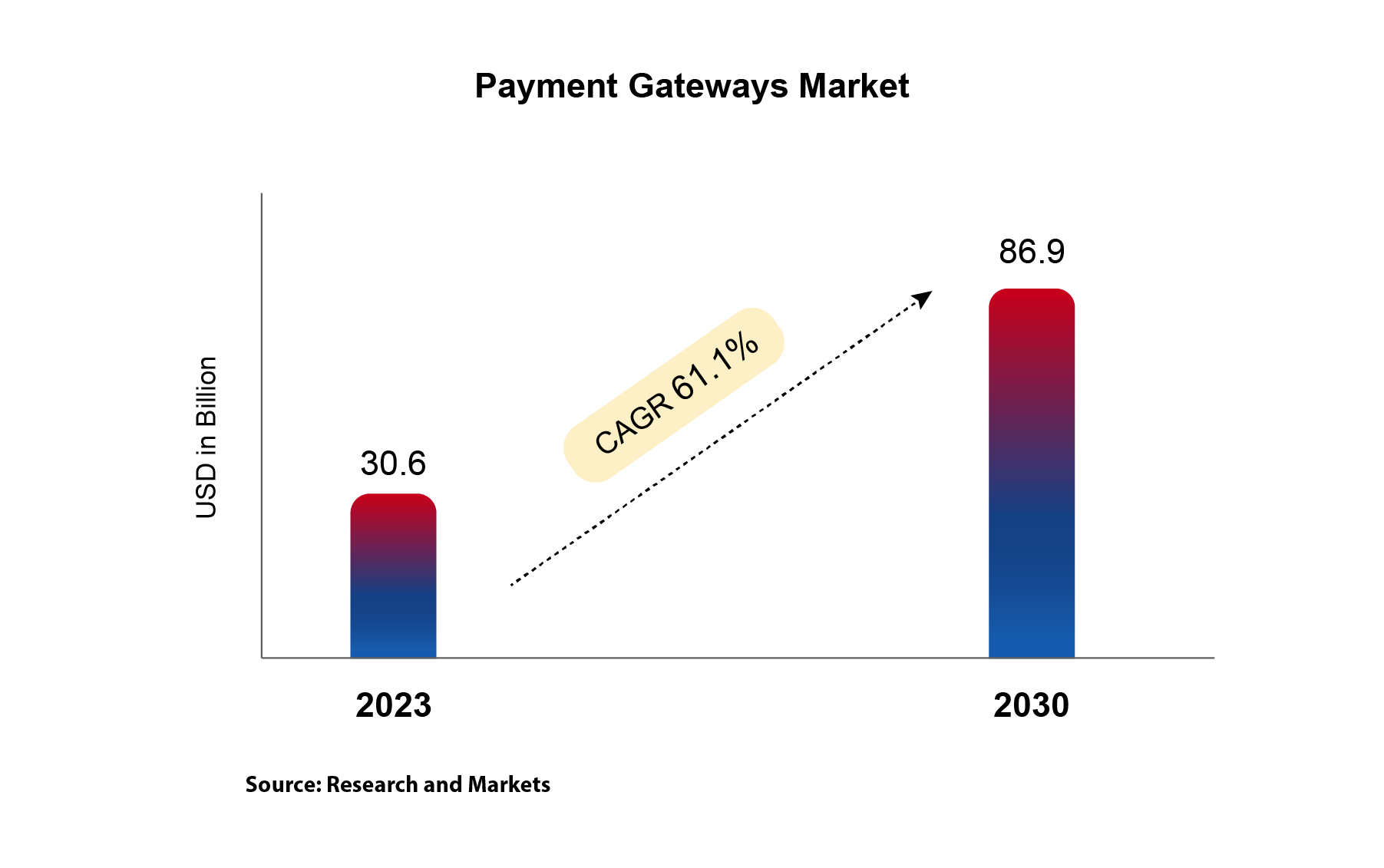

Payment gateway market is set to double in size by 2030.

M2P wins ‘Best Multi-Cloud Implementation Team of the Year’ at Dine with DevOps 2025 by Technophiles India, recognizing our platform engineering team’s innovation in cloud automation and scalable architecture.

Co-founder Prabhu Rangarajan joined the SparkUp – Leadership Talks Series by the Hindustan Chamber of Commerce, sharing leadership insights to empower startups and foster innovation through collaboration.

Prabhu Rangarajan, co-founder featured on YourStory Media’s ‘In Conversation with Shradha Sharma’, alongside Vishesh Rajaram (Speciale Invest), discussing the forces behind India’s deep-tech momentum. Click here to view the full conversation.