M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Digital banking is evolving. It is no longer solely about transaction speed and efficiency, but about embracing a larger purpose: environmental impact.

Green banking is leading this shift, positioning banks as powerful catalysts for sustainability. By channeling investments into renewable energy, energy-efficient systems, and low-emission technologies, banks are supporting environmental progress while driving financial growth.

But why is this the turning point for sustainable finance?

With a $7.4 trillion annual climate funding gap reported by the Climate Policy Initiative and the global commitment to net-zero emissions by 2050, banks are prioritizing green banking while aligning with international green loan principles for transparency and measurable impact. One such initiative is the Green Banking Score, an eco-conscious metric calculated by independent organizations that rate banks on climate-safe practices, such as digital transactions and the ratio of renewable to fossil fuel lending, using a proprietary scorecard that blends objective data with expert analysis to reflect overall sustainability performance.

Regulatory bodies are stepping up to ensure climate risks don’t destabilize financial systems. In India, for instance, the Reserve Bank is strengthening climate risk management by developing national green taxonomy, launching the RB-CRIS to map vulnerabilities, and integrating climate risk into regulatory sandboxes. These initiatives help banks identify and manage climate risks, ensuring a more resilient and sustainable financial system.

Regulation does play an essential role, but technology is the true driver of sustainable finance. Banks are now using AI and real-time carbon tracking with eco-tagged transactions to identify carbon-heavy purchases, enabling banks to nudge customers toward greener choices. AI tools also quantify emissions, like estimating the number of trees needed to offset a transaction, turning climate awareness into daily action and engagement.

With such advancements, the financial sector can now innovate beyond traditional products, giving rise to a new generation of green financial instruments.

The green finance market is expanding beyond traditional green bonds and green equity funds, with new financial instruments accelerating sustainable investments:

Green banking represents a paradigm shift where financial innovation meets environmental accountability. By embedding sustainability into every product and decision, banks can drive real, measurable impact.

Green banking is no longer a trend—it’s the future of finance, reshaping the industry for people, profit, and the planet.

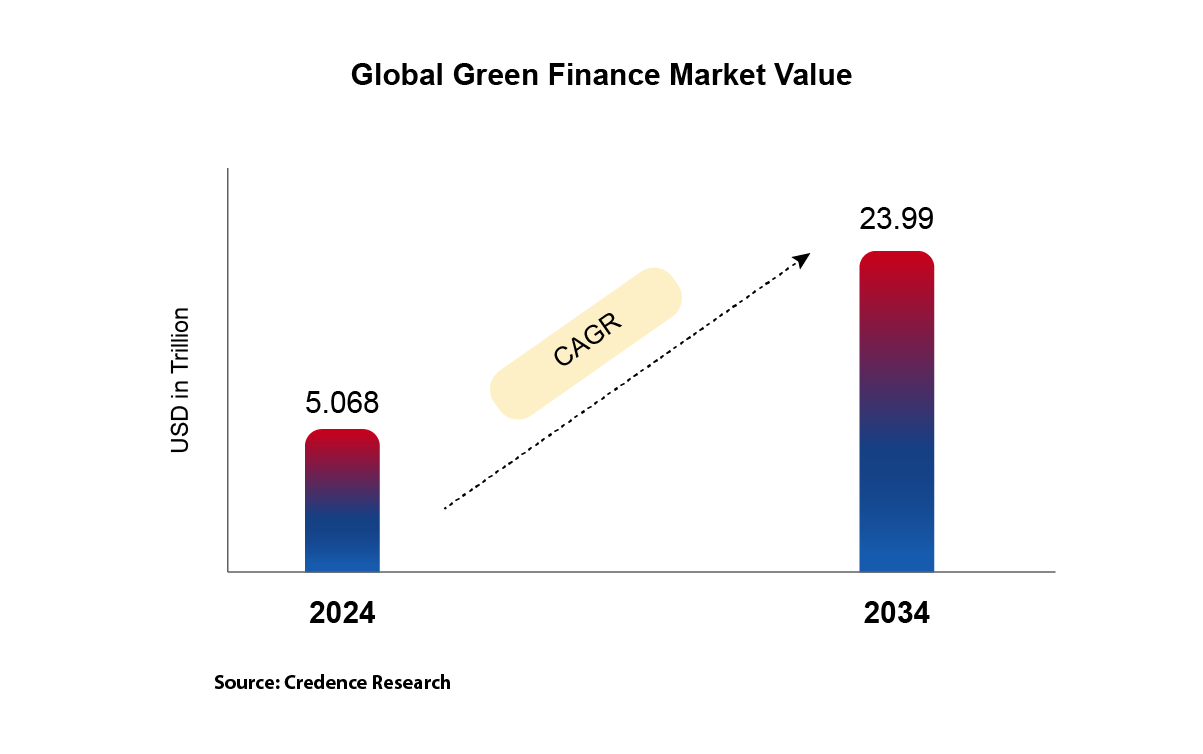

Green finance is booming toward a sustainable future!

M2P showcased Turing CBS and Digital Identity Services at a session hosted by the Maharashtra Urban Co-operative Banks Federation in Aurangabad, engaging with urban banks on accelerating their digital journeys.

We’re thrilled to expand our presence with a new M2P office in Bengaluru, a leading Indian innovation hub, marking a significant leap in reshaping the global fintech landscape.