M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

According to a recent McKinsey report, 67% of banking executives now rank APIs among their highest strategic imperatives, a dramatic leap from their traditional role as back-end enablers. Beyond being just backend tools, APIs have emerged as frontline enablers of innovation, driving growth, unlocking new revenue streams, and powering the seamless digital experiences customers expect.

And the momentum is only building. By 2026, it's projected that 40% of all financial transactions will flow through non-bank platforms leveraging financial APIs, ushering in a new era of interconnected, platform-driven finance.

Hyper-Personalization via Open Banking

APIs are driving hyper-personalized financial experiences by enabling secure data sharing with third-party apps. Through open banking, customer data like spending habits and financial goals can be analyzed to deliver tailored insights, smarter budgeting tools, and customized financial advice.

AI-Powered API Ecosystems

AI is transforming API ecosystems by powering chatbots, fraud detection, and customer analytics. The rise of AI Agents, autonomous systems using APIs to automate tasks and respond in real time is a major shift. Meanwhile, AIOps (AI for IT operations) is helping banks streamline infrastructure, reduce manual effort, and minimize errors driving greater efficiency across digital operations.

Monetization via BaaS (Banking-as-a-Service)

APIs are fueling growth via BaaS platforms, where banks offer modular services like payments, KYC, and lending to external partners. This model enables fintechs, retailers, and non-financial brands to embed banking features into their apps, unlocking new revenue streams and expanding reach into sectors like eCommerce and mobility.

Serverless API Architectures

Serverless computing transforms API development offering scalable, cost-efficient, and easily deployable solutions. In open banking, serverless APIs support high transaction volumes with reliable performance, helping institutions quickly adapt to customer demands and regulatory changes. For credit unions, this architecture enables affordable scalability and enhanced digital services.

Mobile-first API Strategies

With mobile, APIs ensures seamless integration of financial services into smartphones, wearables, and IoT devices, enhancing accessibility and user engagement. Leveraging APIs means gaining the agility, speed, and precision needed to create value at every digital touchpoint.

API-driven banking is no longer a future vision, it’s the present reality shaping the next generation of financial services.

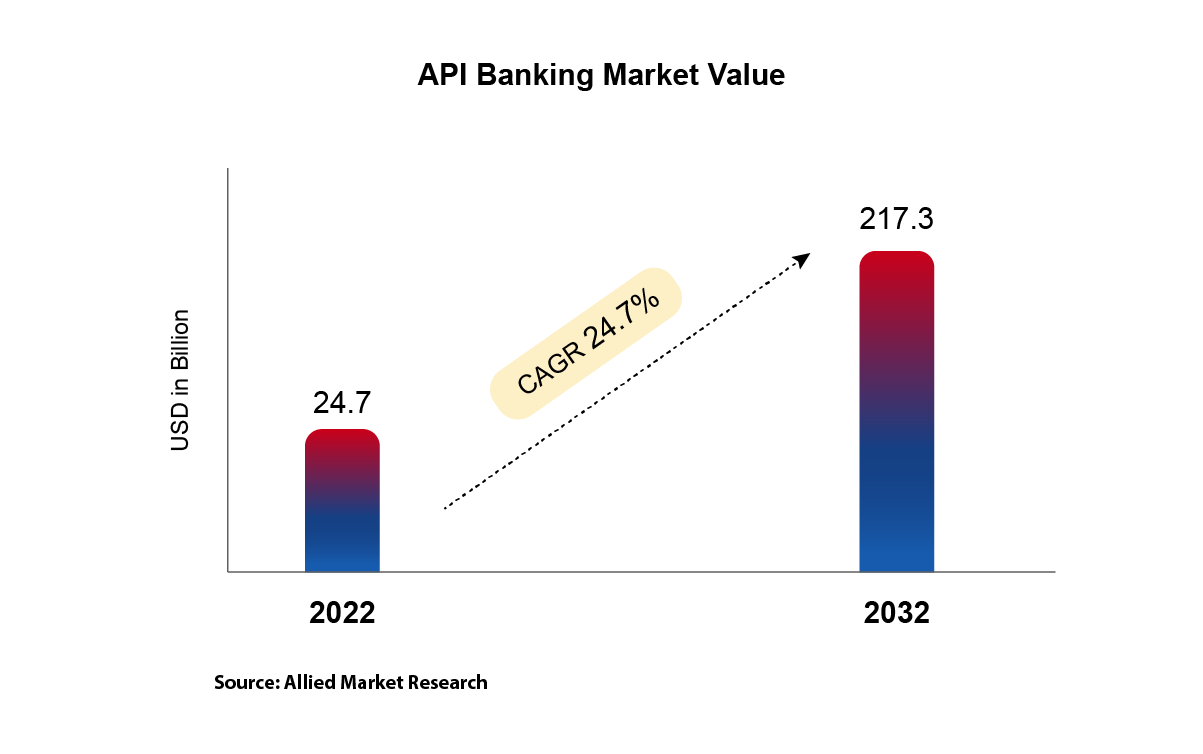

API banking on a steep upward trajectory!

Co-founder, Madhu participated in the Asia Pacific Financial Technology Conference hosted by Goldman Sachs, focusing on “India FinTech: Driving Innovation and Inclusion in Financial Services.”

Our founders Madhusudanan R, Muthukumar A, and Prabhu Rangarajan joined Shradha Sharma of YourStory to share their vision and journey in transforming India’s payments and fintech landscape. Click here to watch the video.