M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Success isn’t just about going global; it’s about going local, everywhere.

For today’s leading brands, growth is measured not just in new markets entered but by the depth of meaningful relationships built at the grassroots. Glocalization is the strategy for companies determined to be both everywhere and truly relevant, bridging the gap between global reach and local resonance.

Glocalization is especially vital when it comes to payment solutions. Today’s consumers expect to pay using familiar, trusted methods. Leading payment platforms have adapted their offerings to support region-specific payment methods such as UPI in India, iDEAL in the Netherlands, and Alipay in China, empowering businesses to offer hundreds of local payment options through a single integration. This removes barriers and builds trust across borders.

Recent advances in payment technology have made it possible to connect with multiple networks and platforms through a single integration, reducing friction for both businesses and end users. No-code tools now allow for the easy creation of localized onboarding journeys, while built-in translation and flexible deployment options help ensure compliance with local standards and data requirements. M2P products are designed with these features in mind, offering seamless integration, localization, and flexibility to support businesses as they expand globally.

By prioritizing these glocal capabilities, we help organizations deliver experiences that are both familiar and trustworthy, removing barriers to adoption and building lasting relationships in every market.

Achieving effective glocalization at scale requires more than manual effort. Leaders must invest in technology and strategic partnerships. This includes using fintech-specific localization tools, partnering with local experts to address regulatory and cultural nuances, prioritizing integrated platforms that unify global infrastructure with local support, and providing localized customer service and documentation to build trust and engagement.

By combining global vision with local insight and leveraging the right partners and technologies, companies can create payment solutions that inspire trust, drive adoption, and fuel growth, no matter where their ambitions take them.

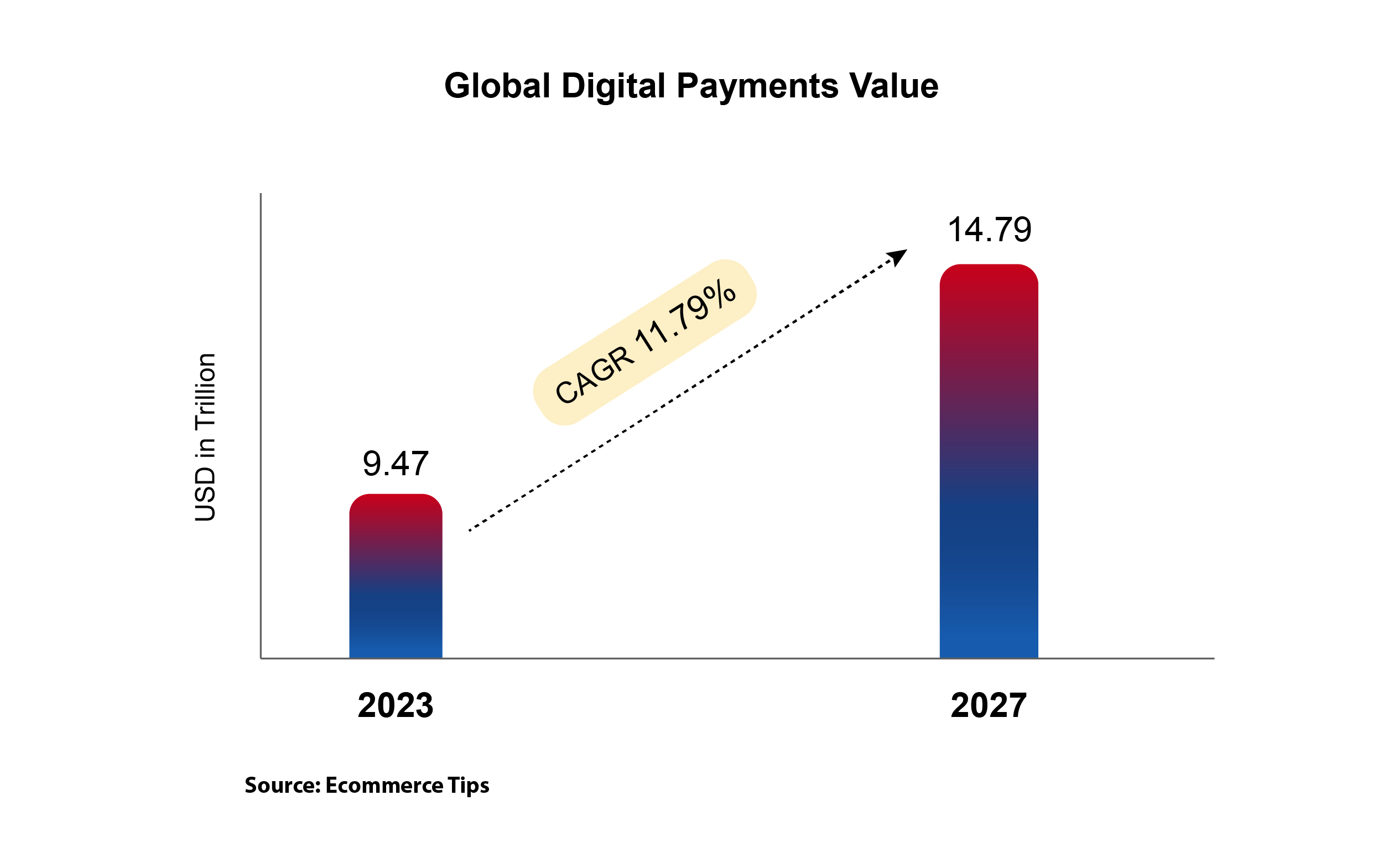

Digital Payments revenue is projected to reach $14.79 trillion by 2027.

At the Chamber of Thrift Banks Annual Convention in the Philippines, Abhishek Arun, President of Platform Strategy & Commercialization at M2P, presented “From Legacy to Leapfrog: A Roadmap to Digital Lending for Thrift Banks.” He highlighted how M2P’s Core Lending Suite empowers thrift banks to modernize their lending infrastructure and accelerate digital transformation.