M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Instant, secure payments are now a necessity for businesses and consumers alike. Yet traditional payment methods often cause delays from batch processing and intermediaries, slowing down settlements that should be near instant.

Account-to-Account (A2A) payments are changing the landscape by transferring funds directly between bank accounts, bypassing intermediaries to deliver faster, more efficient, and secure transactions.

Recent innovations are pushing A2A payments even further:

A real-time, interoperable, mobile-first system supporting P2P, P2M, recurring mandates, and credit lines. Innovations include UPI Lite, UPI Credit, UPI on RuPay Credit Cards, and international payments.

Launched by Banco Central do Brasil, Pix offers real-time payments via QR codes, aliases (email/phone), and 24/7 availability. With over 140 million users, it is replacing cash and cards in many scenarios.

Digital fiat currencies issued by central banks that enable programmable payments, offline transfers, and enhance financial inclusion. Examples include India’s e₹, Nigeria’s eNaira, China’s Digital Yuan, and pilot programs in Europe and the US.

Networks like FedNow (US), SEPA Instant (EU), and Faster Payments (UK) focus on business payments, payroll, and merchant settlements to facilitate seamless real-time transfers.

Instant A2A payment rails like RTP are not just new technologies; they’re redefining how money moves for everyone. In fact, businesses saving 1–2% per transaction by adopting A2A could see major efficiency gains. As real-time account-to-account options become standard for bill payments, payroll, and e-commerce, 2025 may be the year A2A payments truly become the backbone of global digital economies.

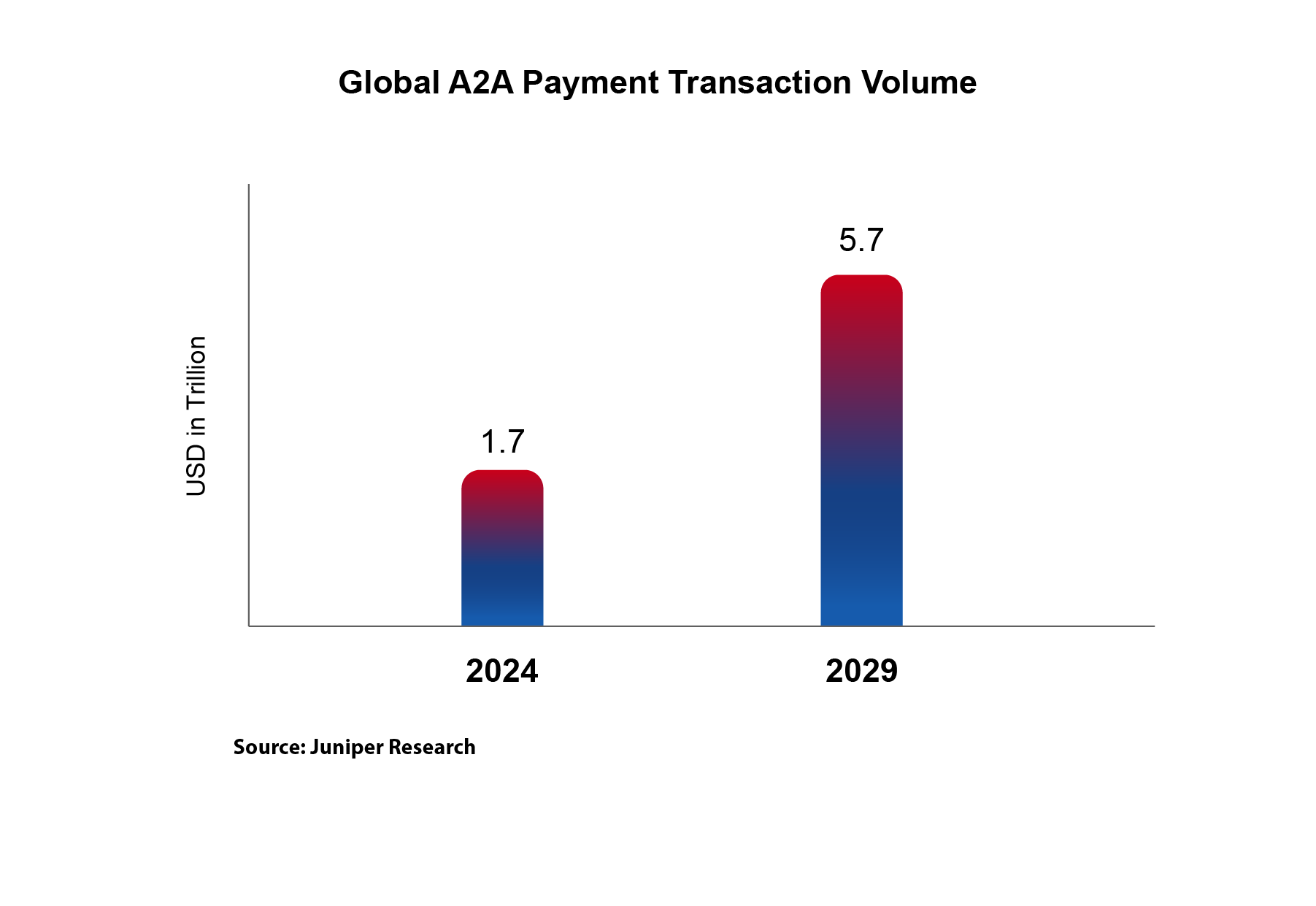

A2A payment transactions are on track to soar 230% from 2024 to 2029.

M2P powered the launch of India’s first biometric authentication solution for e-commerce, developed in collaboration with Federal Bank and MinkasuPay. This innovation enables secure, seamless online payments using fingerprint or Face ID, setting a new standard for speed, security, and user experience in digital transactions.