M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Central Bank Digital Currency (CBDC), a digital version of a country's official money, issued by the central bank and backed by the government. It acts as a legal tender, offering a secure, accessible, and efficient way for people and businesses to make payments.

This digital currency aims to boost payment efficiency and financial inclusion, paving the way for innovations like cross-border settlements. India’s e-Rupee has witnessed a tenfold surge in circulation, with ₹1,016 crore in retail CBDC, supported by 17 banks and over 6 million users. The Reserve Bank of India is now exploring cross-border CBDC pilots, targeting efficiency gains in international settlements.

Beyond India, central banks around the world are accelerating CBDC pilots. In Australia, the ‘Project Acacia’ wholesale CBDC program is testing 19 real-asset use cases, from carbon credits to trade receivables, across platforms like Hedera and R3 Corda. Concurrently, Brazil is scaling its CBDC, Drex, alongside a progressive regulatory framework to drive institutional and retail adoption.

As digital currencies reshape payment rails, policymakers face critical design choices. While the Bank of England and ECB advance privacy-centric CBDC frameworks, the U.S. favors stablecoins—private, asset-backed digital tokens—over retail CBDCs. These different strategies reveal not just the promises of CBDCs but also the political complexities driving their global adoption.

Furthermore, CBDCs must coexist with existing financial ecosystems without disrupting the banking sector’s vital credit intermediation role. Thoughtful interoperability standards and robust cybersecurity protocols are essential to safeguard financial stability and consumer trust.

Experts highlight CBDCs’ role not just as digital currency but as catalysts for transforming national and cross-border payments, supporting financial stability, and maintaining trust in sovereign currencies in a rapidly evolving digital economy. Embracing a holistic, forward-looking approach to CBDCs will be critical. It’s not merely about digitizing money but reimagining financial infrastructure to unlock inclusive growth, resilience, and sustainability on a global scale.

CBDCs are poised to redefine monetary systems, bridging digital innovation with policy stewardship. For leaders in finance and fintech, the imperative lies in designing CBDCs that are scalable, compliant, and globally interoperable.

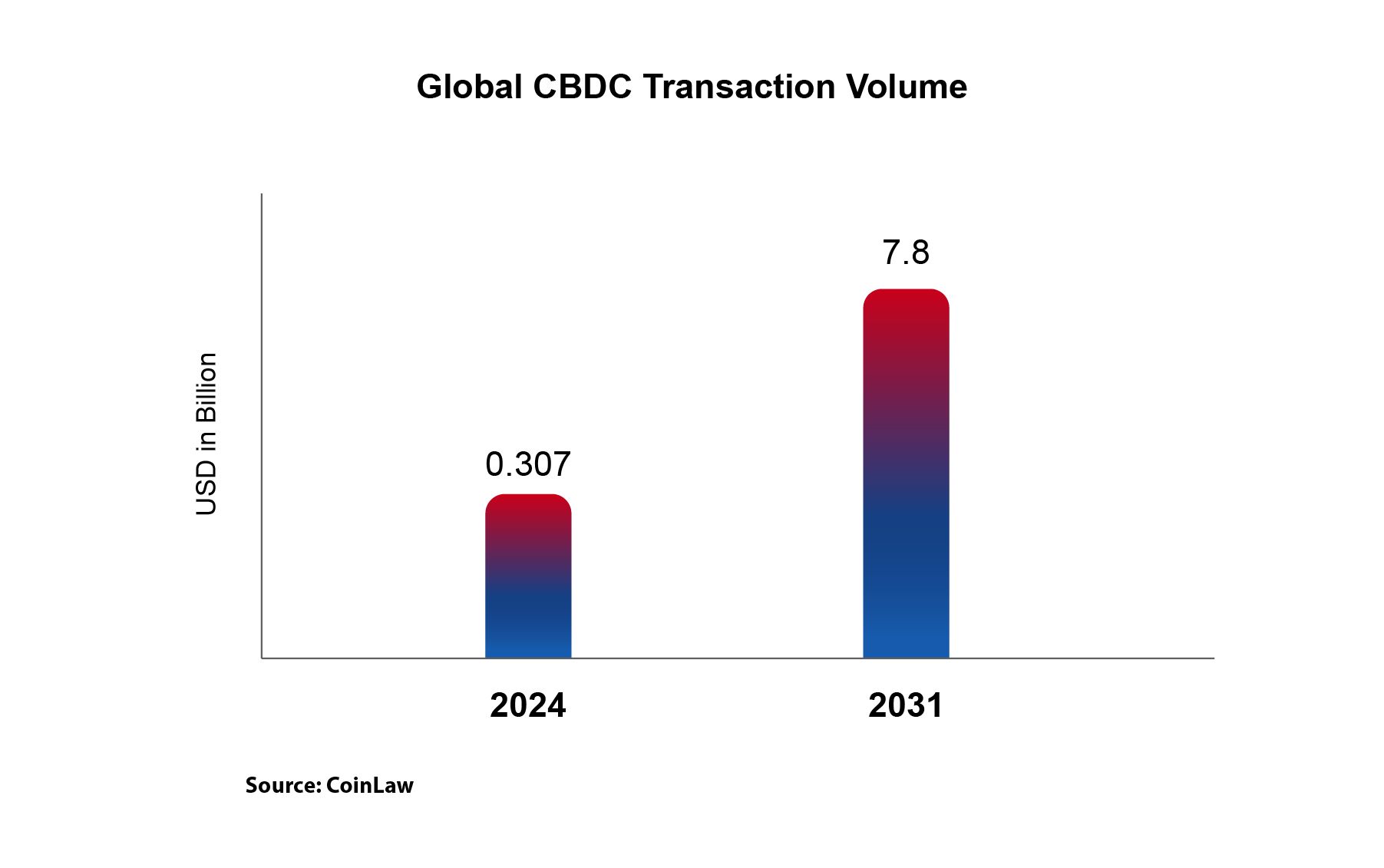

Global CBDC transactions are projected to surge drastically, fueled by growing adoption and trust.

Meet M2P at the Global Fintech Fest 2025, Mumbai, and explore the latest in banking, lending, payments, and data.

M2P participated as a Silver Sponsor at Indonesia Digital Bank Summit (IDBS) 2025 in Jakarta, supporting digital trust and AI innovation.

M2P is a Silver Sponsor for the SME Finance Forum 2025 in Johannesburg, helping foster financial inclusion and partnership for SMEs.