M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Financial fraud is evolving rapidly, and the systems built to detect it must evolve even faster. Projected fraud losses are expected to reach $40 billion by 2027, driven by increasingly sophisticated AI-enabled scams, creating unprecedented challenges for financial institutions.

Traditional rule-based monitoring systems, once reliable, are now struggling under the scale and complexity of today’s threats. According to the UN, nearly $2 trillion is laundered globally each year. Static systems, limited by rigid logic and high false-positive rates, are no longer sufficient.

The advent of AI-powered transaction monitoring has reshaped the landscape. As per McKinsey report these intelligent systems can reduce fraud detection time by up to 85%, enabling near real-time intervention. By continuously learning from patterns, adapting to emerging risks, and uncovering hidden anomalies, they equip financial institutions with a dynamic, proactive approach to safeguarding trust and ensuring resilience.

AI and machine learning (ML) are revolutionizing transaction monitoring by enabling a proactive, highly efficient, and accurate approach to detecting suspicious activity. Here are some ways these technologies are transforming:

As financial crimes grow increasingly sophisticated, AI is rapidly becoming the backbone of effective transaction monitoring systems. Next-generation platforms combine continuous learning, contextual insights, and seamless integration with compliance operations, making fraud defense more intelligent and adaptive than ever.

For institutions aiming to remain agile and trustworthy, investing in AI-powered transaction monitoring is an essential foundation for future-ready compliance and security.

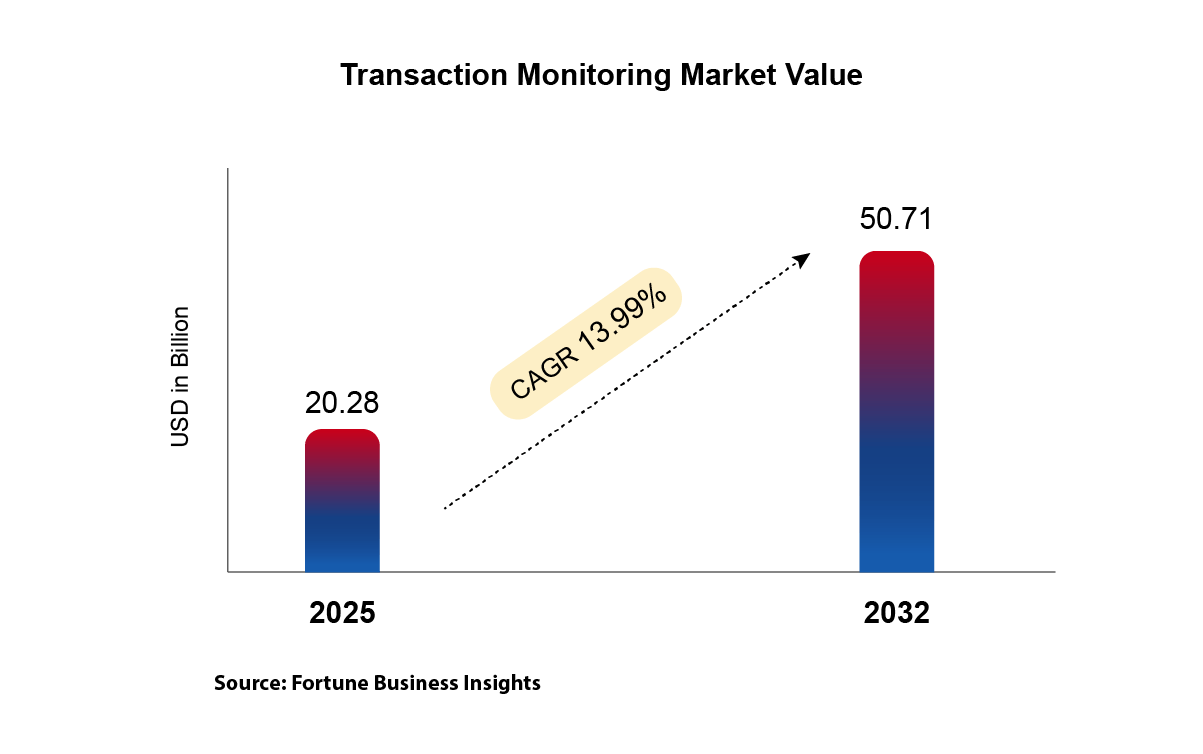

Transaction monitoring is set to surge!

Madhusudanan R, Co-founder, participated in the curtain raiser press conference at the Global Fintech Fest 2025. His session sparked powerful conversations on innovation, inclusion, and the future of fintech.

Abhishek Arun, President – Platform Strategy & Commercialization at M2P Fintech, will be moderating a key session at Global Fintech Fest 2025.

M2P Fintech participated as a Silver Sponsor at the Indonesia Digital Bank Summit (IDBS) 2025 in Jakarta, joining over 500 leaders from banking, fintech, and tech to shape the future of trusted and inclusive digital finance.

Vaanathi Mohanakrishnan, President – Middle East & Africa, joined a roundtable discussion on “De-Risking SME Finance: From Data Deserts to Scalable Guarantees”, at the Global SME Finance Forum 2025 in Johannesburg.