M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Surrogate Product

Robust credit underwriting with secure API-driven insights from payroll, GST, and alternative data sources—enabling faster, more inclusive loan approvals for banks and NBFCs

Surrogate ensures the authenticity of credit applicants by collecting critical data points like, enabling more reliable and informed underwriting decisions

Payroll

Gathers payroll data from the applicant’s HRMS for accurate credit evaluation

GST

Sources GST filing data to streamline loan approvals

Card For Card

Utilizes existing credit card data to check creditworthiness

Bank Statements

Uses applicant’s bank statements for credit assessment

EPFO

Leverages EPFO data for faster and precise loan approvals

Registration Certificate (RC)

Incorporates vehicle RC data into credit underwriting

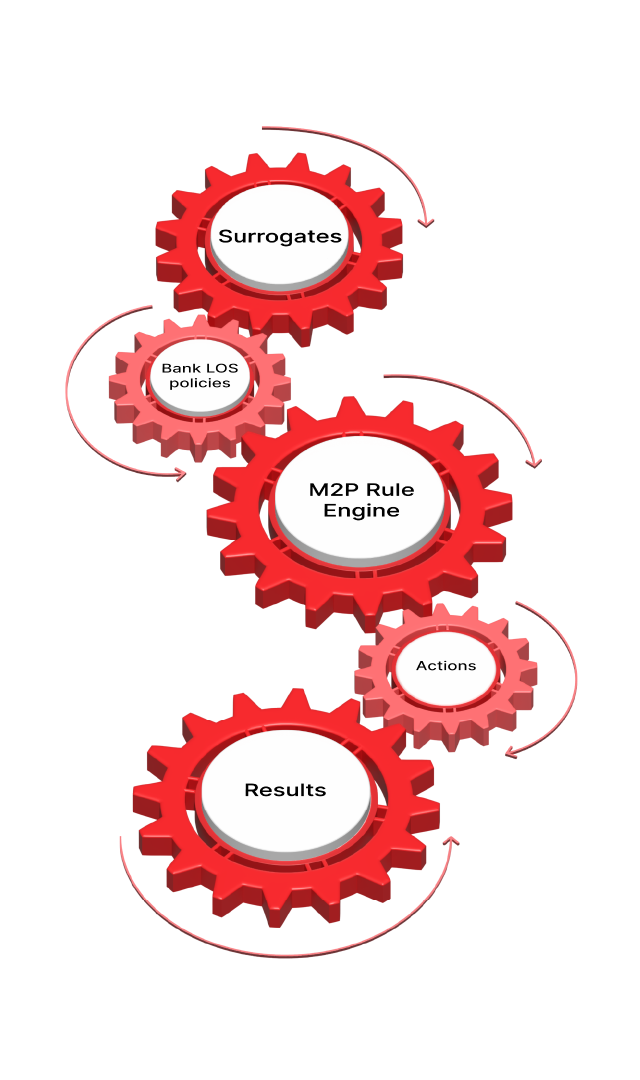

Our advanced rules engine leverages multiple data points to deliver accurate credit decisions while seamlessly optimizing the entire credit application process from data collection to decisioning

Our workflow simplifies the process, enabling banks and NBFCs to make more reliable and accurate credit decisions

Discovery

Parse the customer's basic details

Perform various fraud checks

NSDL / Experian / Hunter / TRAI / AML APIs

Check customer serviceability

Negative Pin code

Evaluation

Verify documents to prove credit worthiness

Bureau / Account Aggregator / Payroll / GST / Card-For-Card / GSTN / Transunion

Run the rule engine to check eligibility on policy

Confident Rule Engine

Calculate credit limit

Validation

Verify customer identity

Field verification / Tele verification / e-Gas-bill / V-KYC

Issue loan/card if the above steps are successful

STP / CMS

Faster Underwriting

Automated access to surrogate data via APIs accelerates the loan underwriting process

Customise Credit Rules

Tailor credit rules to fit your institution’s specific needs with flexible, data-driven underwriting models

Reduce Risks

Leverage verified alternative data to minimize lending risks and make more informed decisions

Improve Loan Eligibility

Use comprehensive data insights to enhance applicants’ loan eligibility, expanding approval potential