M2P Fintech

Fintech is evolving every day. That's why you need our newsletter! Get the latest fintech news, views, insights, directly to your inbox every fortnight for FREE!

In today’s mobile-first economy, even traditional banking touchpoints like ATMs are going cardless.

Earlier, many banks facilitated cardless ATM withdrawals using reference numbers or OTPs sent to the customer’s registered mobile number, typically as part of remittance services. However, this approach lacked interoperability and scalability across networks.

To address these limitations, the National Payments Corporation of India (NPCI) has launched UPI ATM Cash Withdrawal. By introducing cardless withdrawals, this innovation is reshaping cash access for end users, making transactions quicker, more secure, and accessible to all.

Let’s understand what UPI ATM cash withdrawal actually is.

UPI ATM cash withdrawal, also known as Interoperable Cardless Cash Withdrawal (ICCW), is a service that enables users to withdraw cash from participating ATMs using any UPI-enabled mobile app, without needing a physical debit card. This interoperable solution works seamlessly across multiple banks and ATM networks by authenticating transactions through the UPI platform, making cash access faster, more convenient, and secure.

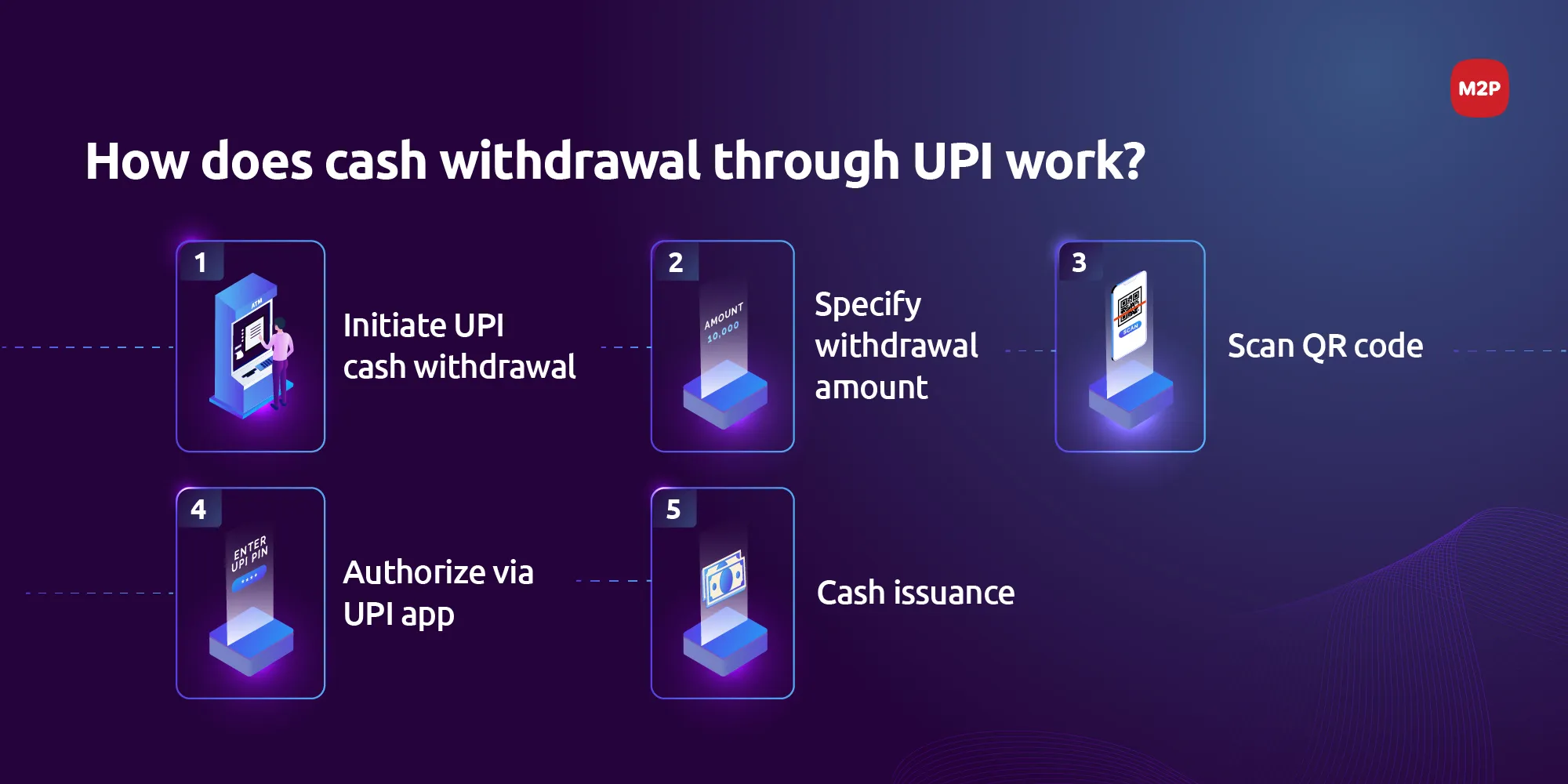

Below is a step-by-step overview of the user journey to illustrate how the process works:

Initiate UPI Cash Withdrawal

To start, the user selects the ‘UPI Cash Withdrawal’ option on the ATM screen.

Specify Withdrawal Amount

Then, the user inputs the desired withdrawal amount, up to ₹10,000 per transaction, subject to UPI and bank limits.

Scan QR Code

The ATM then generates a dynamic QR code, which the user scans using any UPI-enabled mobile app.

Authorize via UPI App

Once scanned, the user confirms the transaction by entering their UPI PIN within the app.

Cash Issuance

Upon successful authentication, the ATM dispenses the cash instantly.

This simple yet secure flow eliminates the need for physical cards or OTP-based authentication while offering users the flexibility to withdraw from any linked UPI account instead of a single bank card.

UPI-enabled ATM withdrawals represent more than just consumer convenience; they unlock new possibilities for operational efficiency, infrastructure optimization, and inclusive financial growth.

Key areas where this innovation is delivering measurable value include

By offering a truly cardless withdrawal journey, banks can meet the evolving expectations of digital-first consumers.

Integrating ATMs into the UPI ecosystem increases utilization of existing assets while simultaneously boosting digital transaction volumes.

Card-related frauds like skimming and cloning are mitigated since there is no card involved in the process.

With UPI adoption rising rapidly in rural and semi-urban areas, cardless withdrawals expand cash accessibility where card penetration remains low.

This QR-code-based, interoperable model aligns with India’s larger vision of building a secure, cash-lite, and digitally inclusive economy. Driving this transformation forward are technology providers like M2P, who are actively enhancing and scaling this innovation, bridging the gap between traditional infrastructure and next-gen digital finance.

M2P’s UPI Switch, a scalable, high-performance platform built for modern digital banking needs, empowers banks, PSPs, and TPAPs to launch cardless cash withdrawals quickly and securely. Fully compliant with NPCI and RBI standards, it ensures smooth interoperability across India’s ATM network while empowering financial institutions to achieve:

Built on cloud-native and modular architecture, high transaction volumes with consistent availability and low latency are efficiently handled.

In addition to enabling ATM cash withdrawals, our platform ensures the rapid rollout of emerging UPI features, helping banks stay future-ready.

Transaction limits can be set up to ₹10,000 per withdrawal, fully aligned with UPI regulations and institutional policies.

Every transaction is protected by robust fraud detection and end-to-end encryption, ensuring safety for both banks and customers.

As NPCI drives the rollout of UPI ATM access across India’s 2.59 lakh+ ATM network, M2P’s UPI Switch provides the reliability and agility needed to support this nationwide transformation.

As more institutions adopt UPI-powered ATM access, the lines between digital and physical banking will continue to blur. For banks and fintechs, it’s an opportunity to redefine customer experience and expand service reach. M2P is ready to help you lead this change.

Want to see our UPI Switch in action?

Schedule a quick demo and explore how your institution can enable cardless ATM withdrawals securely and at scale.

Subscribe to our newsletter and get the latest fintech news, views, and insights directly to your inbox.

Follow us on LinkedIn and Twitter for insightful fintech bytes curated for curious minds like you.