M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Microfinance Software

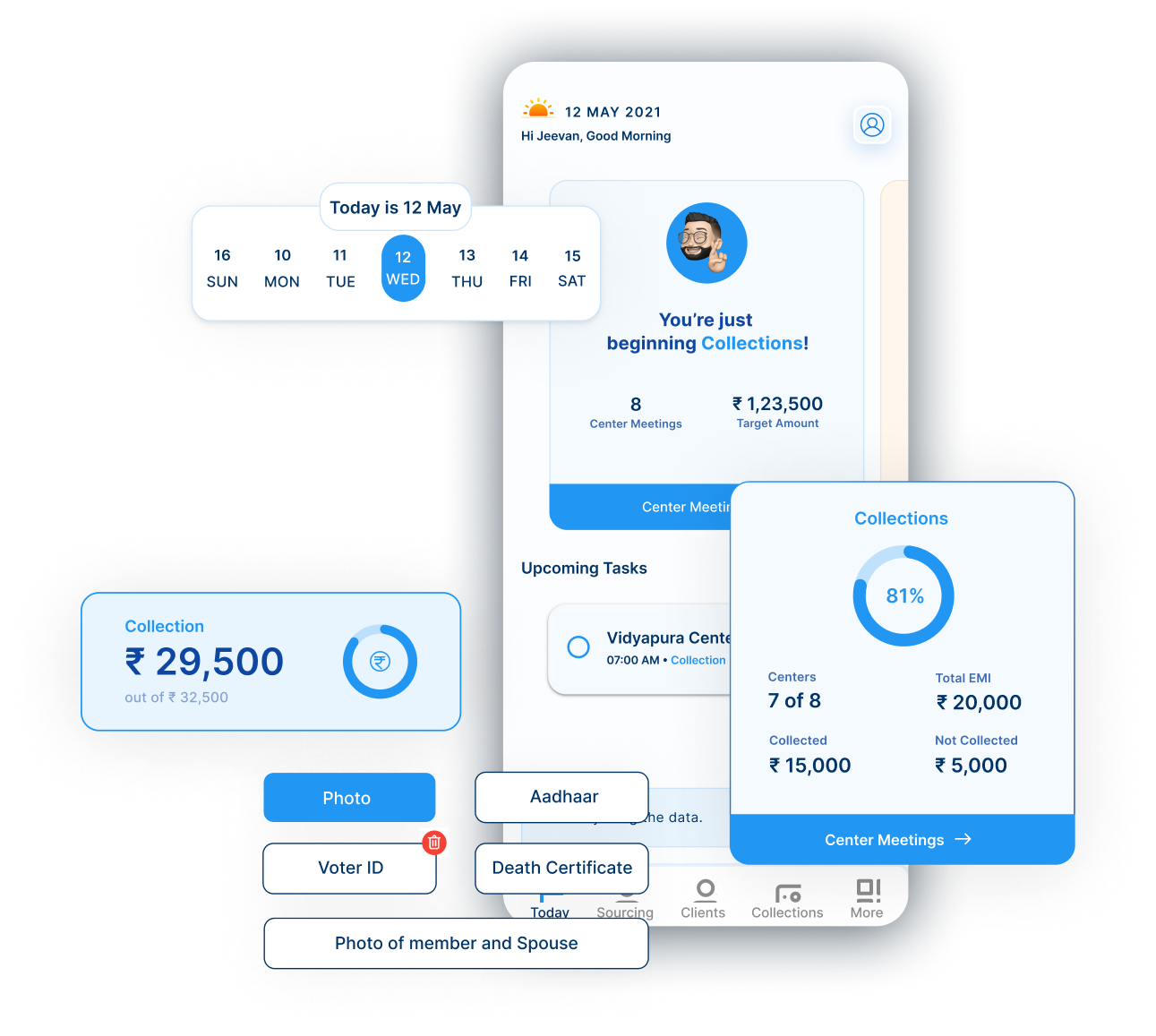

Digitizing microfinance lending and field operations,

powered by our Loanbook app

Seamless onboarding

via app adoption

Geotagging to improve collections

at designated locations

Improvement in

on-time meetings

Informed loan decisioning

with advanced BREs

Scalable cloud infrastructure

Dynamic workflows

Inbuilt credit scoring

Insightful reports and analytics

Loanbook, the field operations enhancer

Effortless offline and online collections

Savings module add-on

1

2

3

6

5

4

Our Microfinance Lending Suite is a comprehensive, pre-configured platform built to digitize and streamline microfinance operations for Banks, NBFCs, and MFIs. It supports the full lifecycle of microloans, including origination, management, collections, and analytics as well as offers a Customer App for better borrower engagement. The suite enables institutions to improve operational efficiency, drive financial inclusion, and continuously enhance end-to-end lending experiences.

Our Microfinance Software simplifies loan origination for both Business Correspondent (BC) sourced and direct loans. It supports individual and group onboarding, digital KYC authentication, household visits, income assessments, and e-signatures. Pre-configured modules accelerate onboarding, while built-in tools enable seamless disbursement and reduce turnaround times.

The system streamlines collections by managing both regular and overdue payments, enabling promise-to-pay tracking, and supporting both cash-based and digital collection methods. It also supports offline collections, ensuring uninterrupted operations. Institutions benefit from configurable workflows and customized product configurations that adapt to diverse collection strategies.

Yes. The platform includes advanced Business Rule Engines (BREs) and AI-powered decisioning tools that evaluate pre-disbursement risks based on customizable credit policies. Additionally, it ensures full compliance with MFI guidelines, helping institutions maintain regulatory alignment throughout the loan lifecycle.

Our microfinance lending suite includes ‘Loanbook,’ a mobile application that digitizes field officer operations—from onboarding and lead verification to collections. In addition, we offer tools that support offline functionality, field-level validations, and real-time sync, enabling institutions to manage field activities at scale with visibility and control.

Our Microfinance Software offers centralized data management, real-time dashboards, MIS reports, and CXO-level insights. Drill-down features, performance reports, and configurable dashboards enable institutions to track KPIs, optimize strategies, and stay ahead of operational bottlenecks.

Yes, the system supports both voluntary and mandatory savings, recurring and fixed deposits, auto-closure of deposit accounts upon loan closure, and savings withdrawals and transfers. This flexibility promotes financial stability and encourages responsible financial behavior among borrowers.

Built on a scalable cloud infrastructure, the microfinance software platform supports secure loan operation management, embedded delinquency management, and high transaction volumes without performance compromise. It is also capable of upstream and downstream integrations, ensuring smooth data flow across systems.

Finflux by M2P offers comprehensive user support, including training, product documentation, and dedicated customer service. Institutions receive personalized assistance to ensure smooth onboarding and optimal utilization of the suite.

To begin, visit m2pfintech.com/micro-finance and reach out through the contact options provided. Our team will guide you through the implementation process and tailor the solution to your institution’s needs.