How AI Agents are Making Customer Service Effortless?

Do you know 88% of businesses are in the process of exploring or piloting AI agents to enhance customer experience instantly around the clock?

Yes, businesses are tapping into the potential of AI Agents, an innovation that’s not just transforming support but setting new standards for speed and satisfaction. In fact, the financial industry alone is poised to save an estimated $7.3 billion in operational costs by 2028 through AI-powered automation, all while slashing response times and elevating customer experience.

With these critical imperatives, AI agents have become a strategic cornerstone for banks and fintechs committed to delivering seamless, 24/7 customer service. These intelligent assistants not only address customer needs but also help organizations streamline operations and elevate client engagement setting a new, competitive benchmark in digital financial services.

Key Benefits of AI agents

- 24/7 Support: Instant responses at any time eliminate waiting, boosting customer satisfaction and loyalty.

- Cost Efficiency: Automation of routine queries frees agents for complex issues, reducing operational expenses.

- Real-Time Security: Continuous monitoring detects suspicious transactions and alerts users immediately.

- Regulatory Compliance: Intelligent agents simplify adherence to regulations and maintain secure audit trails.

- Internal Agility: Streamlined workflows accelerate onboarding, HR processes, and internal banking requests.

Use cases of AI Agents

- Personalized Financial Guidance - AI agents deliver personalized, 24/7 financial support, helping customers build better money habits. For instance, Erica offers spending insights, credit score updates, and smart tips, enabling millions to manage budgets, savings, and loans. This shifts banking from reactive service to proactive guidance.

- Expense Tracking and Insights - AI agents analyze transaction data to offer clear spending summaries, budgeting help, and alerts, aiding better financial control. Digital banks empower customers with AI-driven notifications when they approach budget limits or can optimize their expenses, fostering better money management behavior. Example: “How much did I spend on dining last month?” The AI agents responds with a detailed breakdown and suggests ways to cut costs.

- Instant Account Access & Analysis - AI agents enable instant access to accounting information checking balances, viewing transaction details, or requesting dispute resolution without the friction of phone calls or branch visits. For example, a simple question like “What’s my current balance?” or or “Show my grocery expenses this month” is answered immediately, reducing friction, and wait time.

- Timely Bill Alerts and Balance Updates - Financial AI assistants continuously monitor upcoming payments and account status, sending timely reminders to avoid late fees or overdrafts. For instance, Ceba enhances customer experience by proactively guiding users to stay on top of their bills, thereby reducing missed payments and stress.

- Fraud Detection and Security Notification - AI agents analyze transactions in real-time and, upon detecting unusual activity, immediately alert the user to prevent fraud. For example, leading bank’s AI agents exemplify how they enhance security, acting as vigilant sentinels that protect customers’ financial wellbeing in real-time.

Looking Ahead

Next-gen AI agents will feature hyper-personalization, multilingual support, predictive assistance, and biometric security. Integrating AI agents into customer service strategies is essential for staying competitive and delivering exceptional, personalized experiences on a scale.

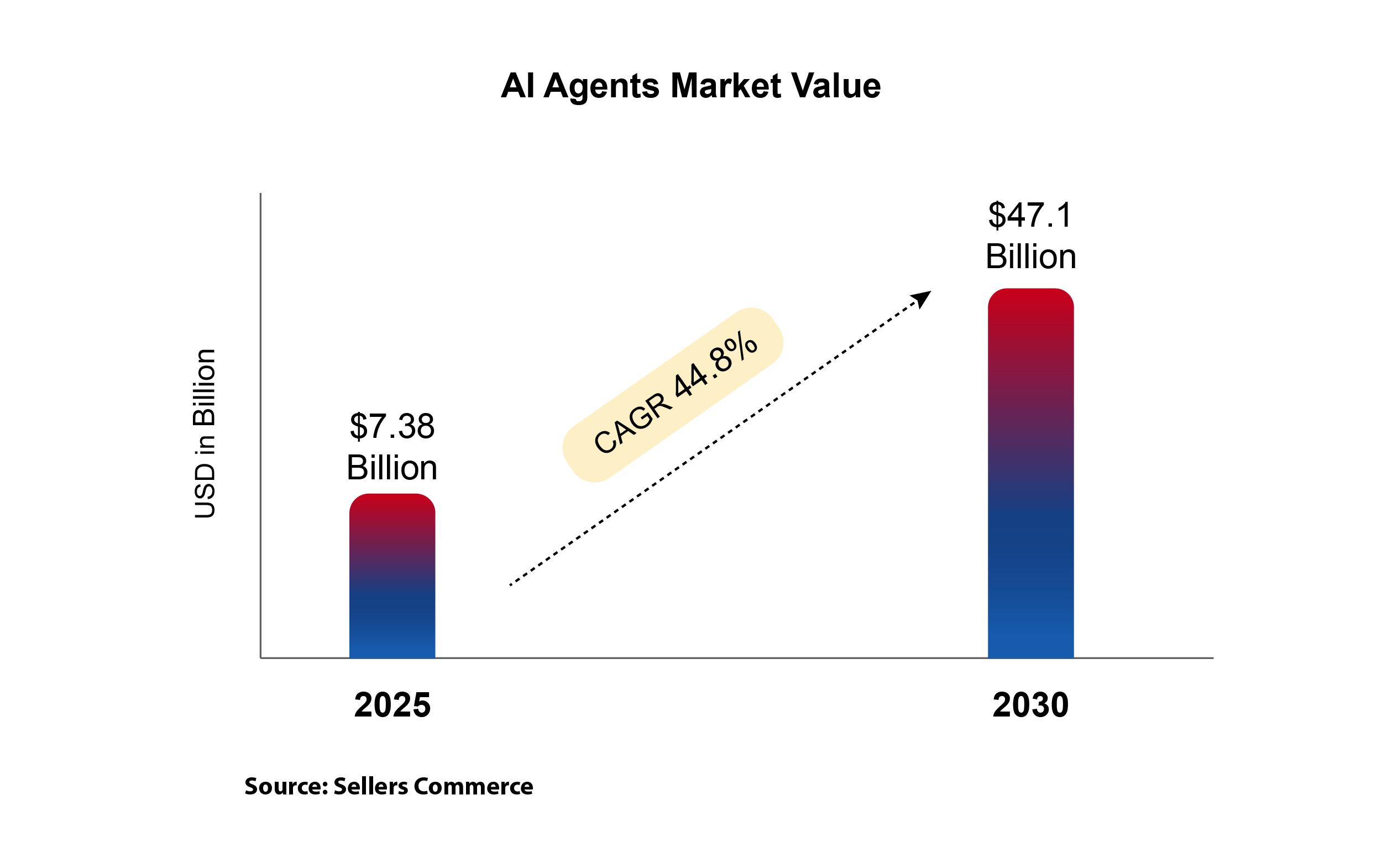

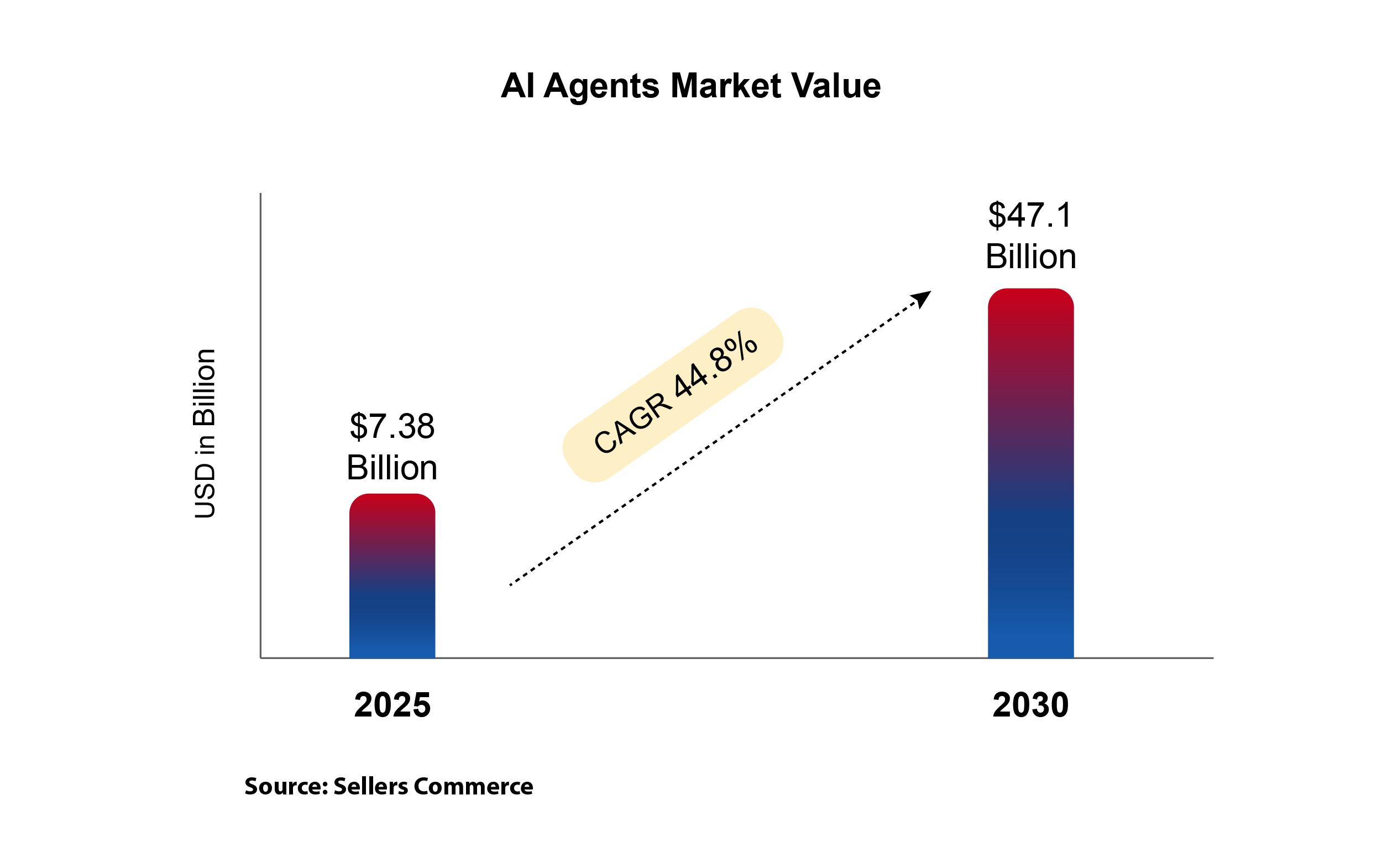

AI Agents market is expected to surge by 2030!

M2P was named among Tamil Nadu’s Top 50 Companies and showcased its pioneering products at the Power Brands Pavilion, reflecting the energy and innovation of the state’s vibrant startup ecosystem.

At the Tamil Nadu Global Startup Summit 2025, M2P hosted a panel on “Shaping the Fintech Landscape of Tamil Nadu”, moderated by Co-founder Prabhu Rangarajan, featuring industry leaders. He also delivered a keynote session on “The Next Wave of Fintech: From Digital Payments to Intelligent Finance”, sharing how technology and data are driving intelligent, inclusive finance across the sector.

M2P proudly powers India’s first weekend-focused credit card — the MagniFi Federal–Fi Credit Card, built on the M2P Credit Card Stack. This co-branded offering by Fi and Federal Bank reimagines how India celebrates its weekends.

That’s a wrap. Stay connected for more fintech insights in the next edition.