M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The global digital banking landscape is on an exponential growth trajectory. The total number of digital banking users is expected to grow at a rate of 54%, pushing the user base well beyond 3.6 billion by 2024.

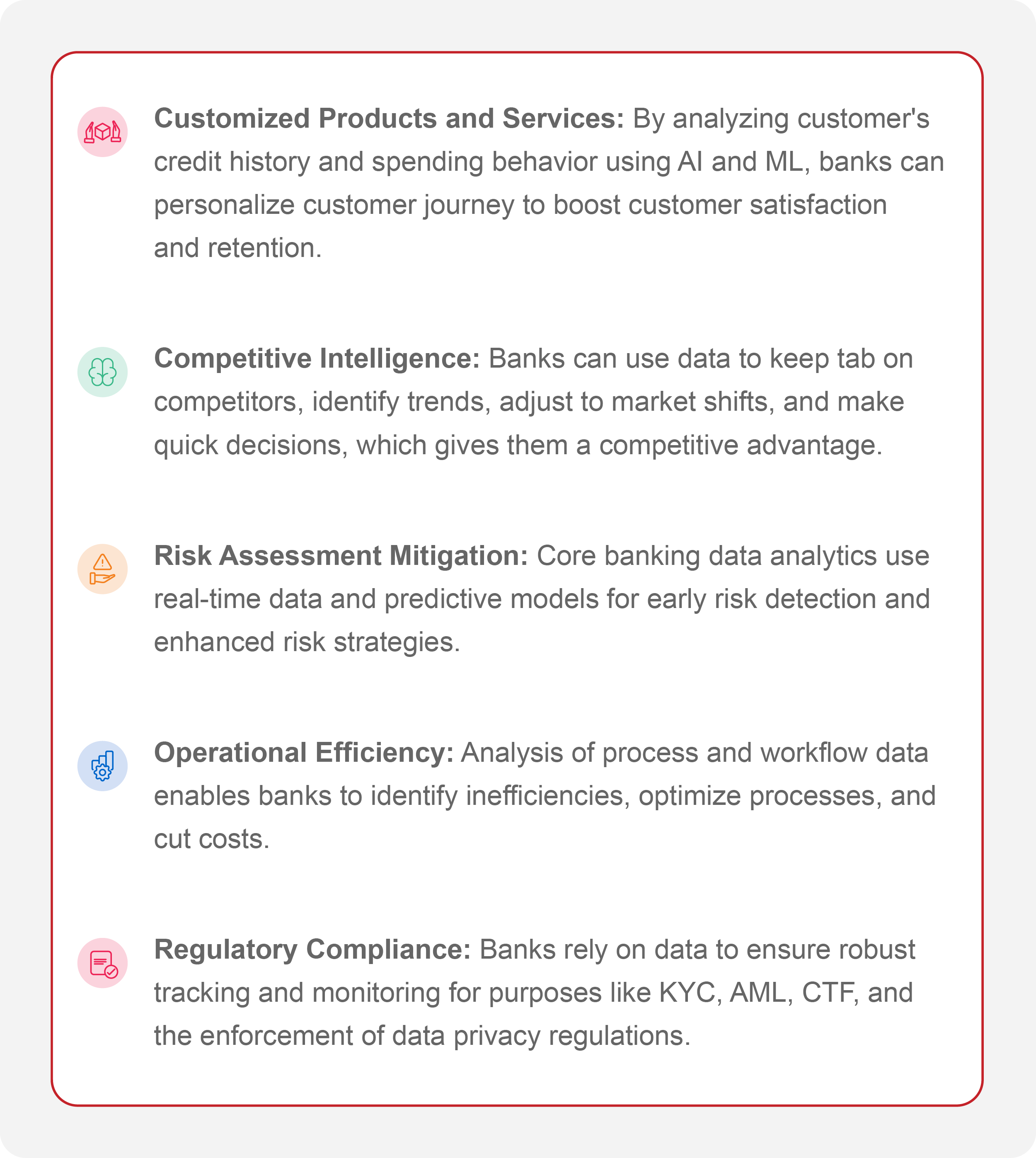

To stay competitive, innovative, and customer-centric, banks need to adopt a strong data-backed decision-making process.

Every click, tap, and transaction generates a digital fingerprint that banks can harness to personalize services, thwart fraud, and drive operational excellence. The infrastructure needed to collect, manage, and analyze data is provided by the Core Banking System (CBS). The collected data enables banks to make precise decisions to enhance product/service customization, operational efficiency, customer experience, compliance, and more.

Data-driven digital banking gives banks a competitive edge, enabling faster decisions, adaptability to market changes, and improved performance.

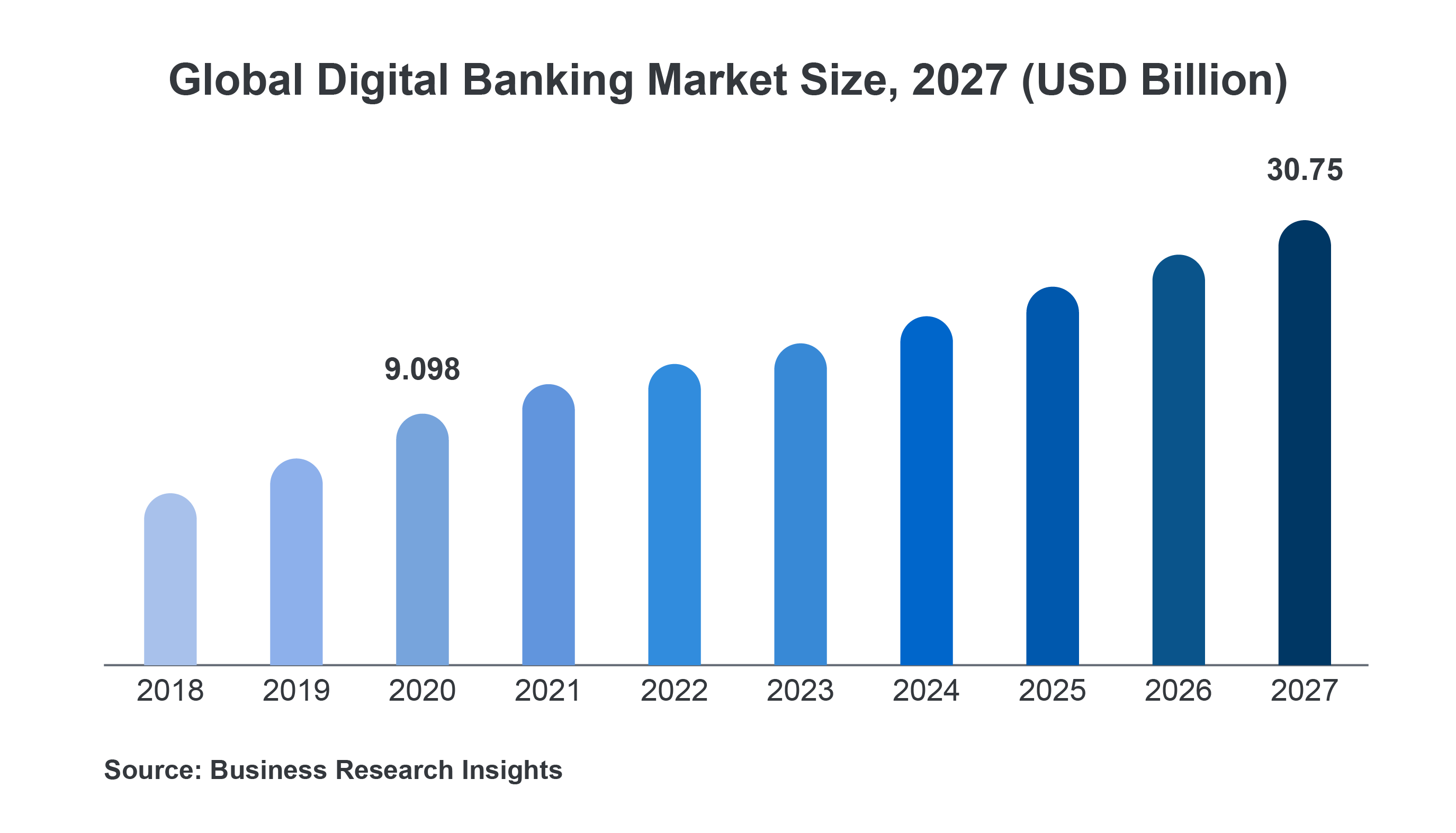

The digital banking market is expected to grow at a CAGR of 19% by 2027.