How to connect lenders with merchants for BNPL payments?

It isn't easy being a BNPL issuer today!

From handling integration between new lenders and merchants to managing transactions and driving success rates, issuers have their hands full.

Thankfully, there is an answer.

Introducing Pay Later+

Pay Later+ is a fully integrated BNPL acceptance platform that connects merchants and lenders to offer low-cost payment solutions for clients. Its salient features include integrated subvention, chargeback, refund, and settlement, and a consolidated merchant dashboard.

What does it offer to Merchants?

What does it offer to Lenders?

If you are looking to upgrade your BNPL operations with improved integration and optimized transactions, click here.

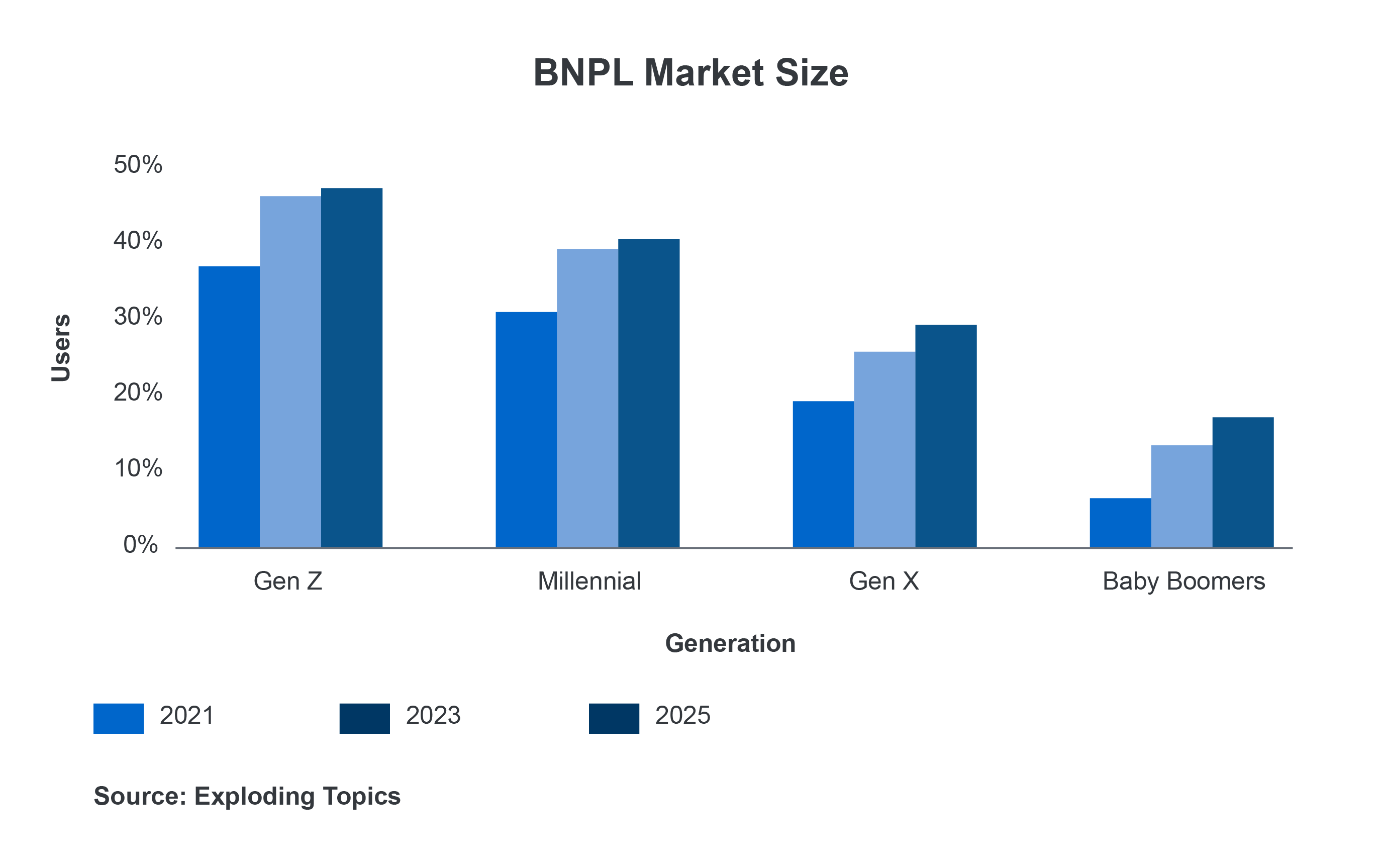

Here’s the breakdown of BNPL users by generation. It is projected that nearly 50% of Gen Z will be using BNPL by 2025.

We are thrilled to announce that Arvog has officially launched on M2P's Loan Origination and Loan Management Systems. Our partnership with them is a significant step towards extending credit to the underserved and unserved segments.

Don't Miss Out!

It costs nothing to stay on top of all things fintech.

Yay! You're part of our FinFam!

Yay! You're part of our FinFam!