M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The booming adoption of Decentralized Finance (DeFi) has driven Total Value Locked (TVL) to over USD 55.95 billion worldwide in 2024. DeFi's rapid growth is set to significantly impact the blockchain industry, nearly tripling global spending to USD 19 billion by 2024, up from USD 6.6 billion in 2021.

Overwhelmed by the numbers? Let's set the context here.

DeFi is a financial technology that provides an alternative to the centralized banking system. It decentralizes traditional financial operations using blockchain technology. DeFi platforms allow people to transact, lend, borrow, trade, insure, save, and even earn on its virtual financial ecosystem.

But DeFi had its shortcomings - regulatory compliance, security, and sustainability.

The most pressing concern among these is carbon emissions resulting from DeFi activities like:

To address these concerns, Regenerative Finance (ReFi) emerged as a sustainable subset of DeFi.

ReFi shows promise for sustainable development, yet challenges like lack of transparency and regulatory hurdles could hinder its widespread adoption. Overcoming these obstacles is crucial for ensuring the success and growth of ReFi and fostering a more sustainable future.

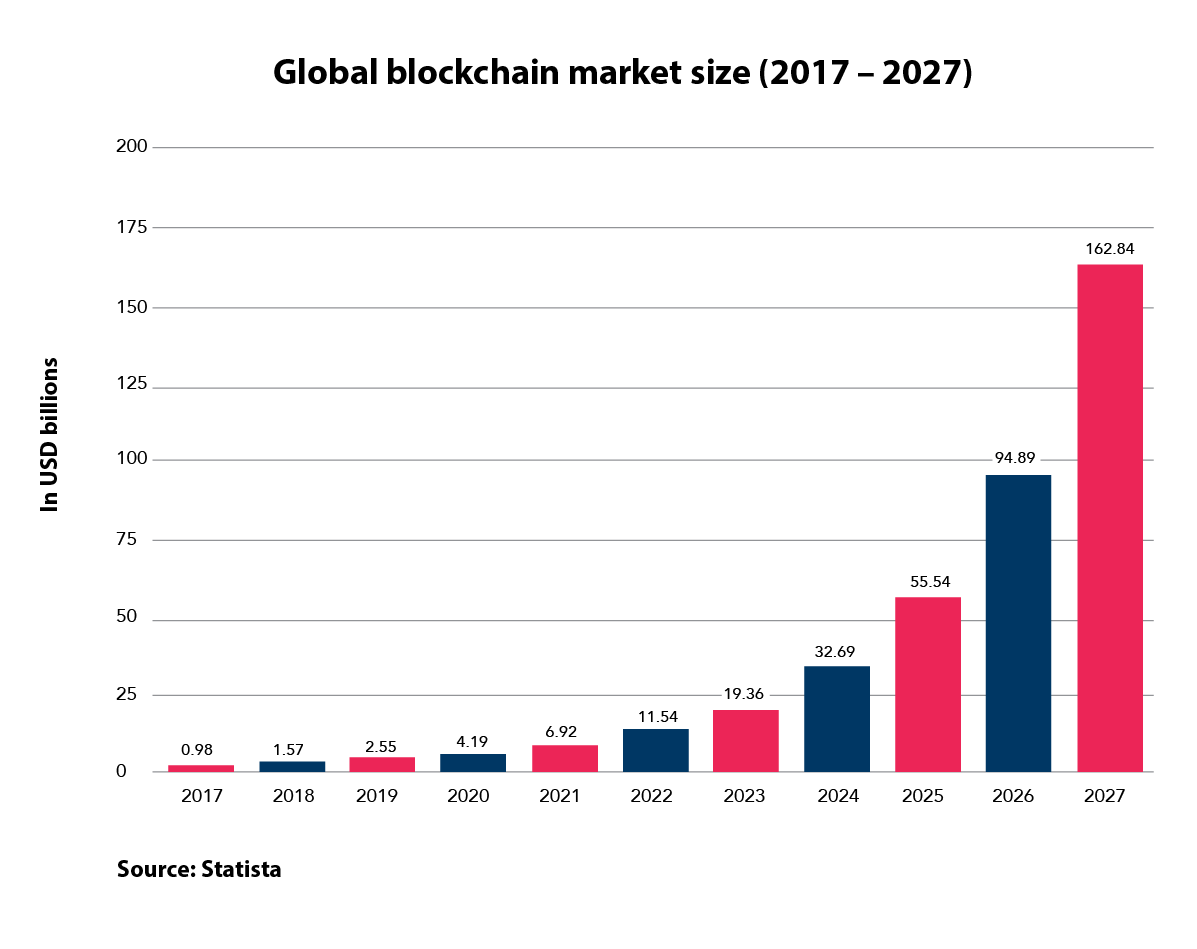

The global blockchain technology market is projected to reach $162.84 billion by 2027.

We are delighted to provide our Loan Origination System (LOS) and Loan Management System (LMS) products to Capri Global Capital Ltd. Through this strategic partnership, M2P supports Capri Global's mission to create significant social impact among financially underserved or unserved communities.

Our Co-Founder, Madhusudanan R, participated in an innovative panel discussion at the Bharat Fintech Summit '24 that happened in Mumbai recently. The panel, titled 'Banks Turning Fintechs: Navigating Digital Transformation – Insights & Learnings For Banks Through The Fintech Playbook,' delved into innovative topics such as banks adopting fintech models, customer-centric digital banking platforms, and emerging trends in the banking landscape.