M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

Managing finances no longer requires countless apps.

Thanks to the advent of Fintech Super Apps, a cohesive mobile application that can help users perform a wide array of financial tasks without needing to switch between different apps. From payments and banking services to investments and loans, these applications play a major role in simplifying finance management.

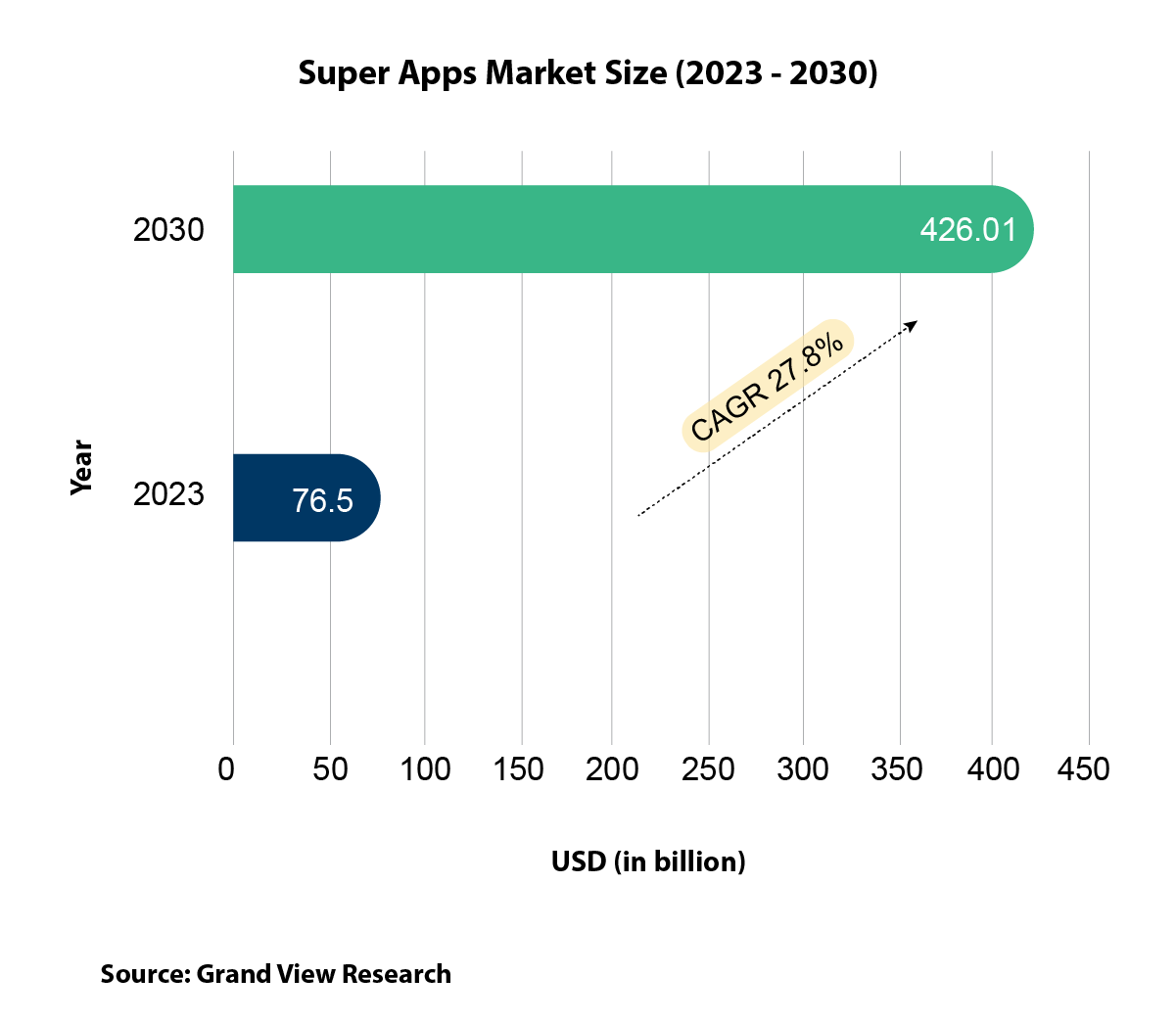

Expected to reach $426 billion by 2030, Super Apps are transforming the fintech landscape with their unified functionality.

This raises the question: will they reshape banking as we know it?

The answer seems likely, and here's why:

Super Apps offers a one-stop shop for financial needs, eliminating the need for multiple apps and passwords. This seamless convenience resonates with today's tech-savvy users.

By catering to a broad demographic, Super Apps addresses the needs of the underbanked, offering them accessible and user-friendly platforms that had previously been out of reach.

The ability of Super Apps to gather and analyze user data opens the door to highly personalized financial products and services designed to meet the unique needs and preferences of each user.

By leveraging technology and streamlining processes, Super Apps can provide quicker loan approvals, transactions, and real-time financial insights.

With their constant evolution and openness in collaboration with traditional banks, Super Apps are creating new opportunities and service offerings.

Super Apps platforms consolidate services, and their potential impact on banking is undeniable. While the full impact is yet to unfold, they are actively revolutionizing how millions of people manage their finances.

The super apps market is set to surge nearly 28% by 2030.

Our Co-Founder, Madhusudanan R, partook in a thought-provoking panel discussion on 'Embracing the global scalability potential for Indian fintech' at the 18th edition of the India Digital Summit.

Visa CEMEA's recent fireside chat on 'Visa and M2P: Empowering Fintech Success' featured Vaanathi Mohanakrishnan, Business Head – MEA, M2P Fintech, along with Hasan Kazmi, Vice President, Head of Digital Partnerships and Ventures, CEMEA, Visa. Click here to watch the full session.

M2P Fintech and Bureau enter a strategic partnership aimed at delivering seamless and secure customer experiences. Together with Bureau's cutting-edge risk signals and our highly configurable ACS/MFA engine and FRM products, we're geared up to enhance the overall transaction experience for customers.

‘AWS EKS Troubleshooting Workshop’ was organized for M2Peers at our Chennai office. Our team had an incredible learning experience as they delved into insightful discussions along with the AWS team. The session also promoted cross-functional collaboration and provided knowledgeable insights on AWS EKS.