M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

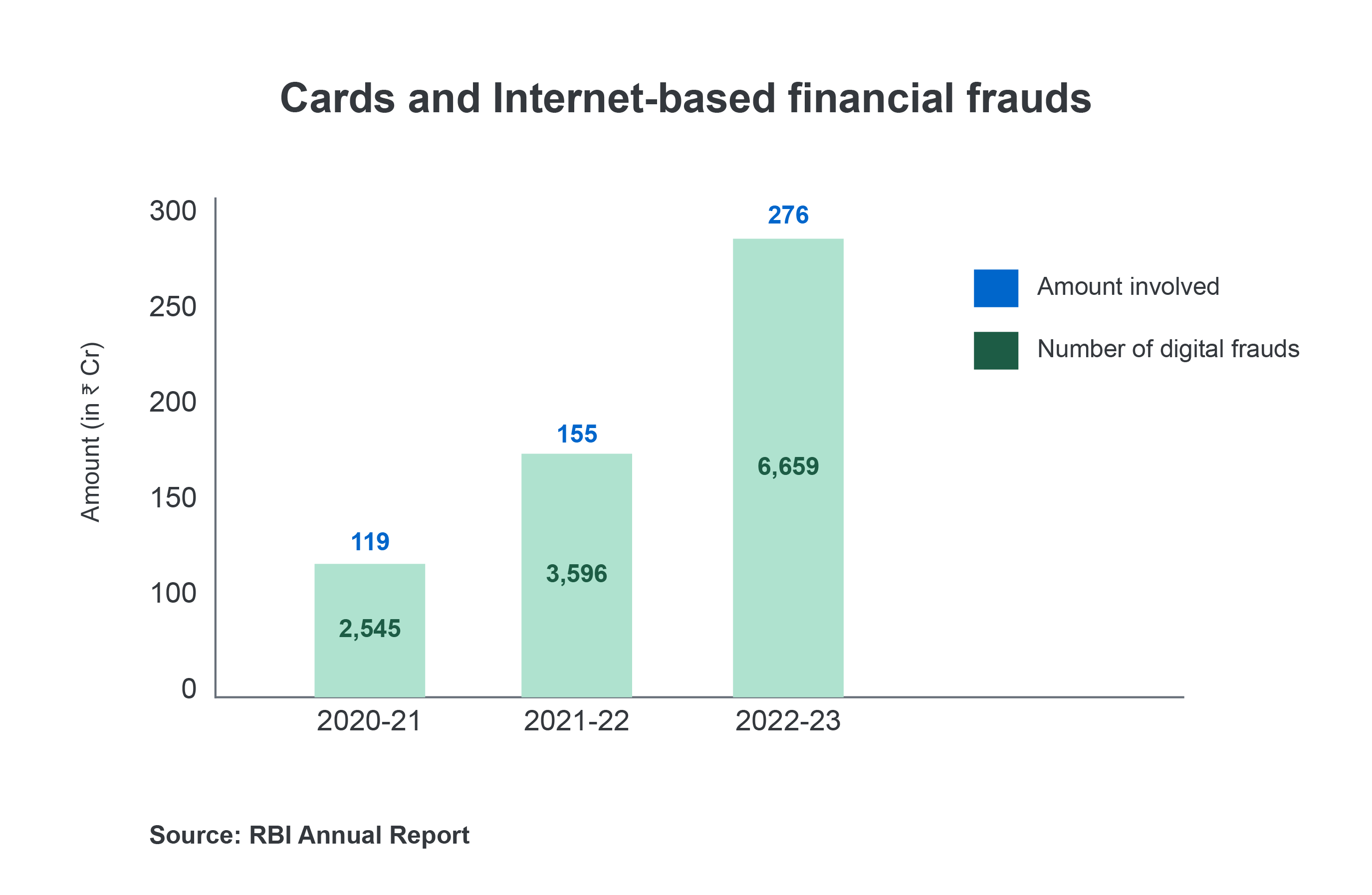

12,069 instances of credit frauds were reported in H1FY24 which is a 3X increase from the previous year.

This surge underscores the critical need for enhanced security measures and robust fraud prevention strategies to combat the escalating threat of transaction-related frauds. Financial institutions and individuals must remain vigilant and adopt advanced technologies and practices to safeguard against fraudulent activities that can lead to substantial financial losses and reputational damage.

Artificial Intelligence (AI) and Machine Learning (ML) are changing the game by spotting potential fraud in real-time through analyzing huge amounts of transaction data. These technologies can identify unusual patterns that might suggest fraudulent activity.

By incorporating AI and ML, organizations can improve their fraud detection methods, adapt to new fraud strategies, and reduce false alarms, making the system more reliable for genuine transactions.

Cloud-based solutions offer scalability, enabling institutions to adapt to changing transaction volumes seamlessly. They facilitate efficient processing of vast amounts of data, empowering organizations to swiftly identify fraudulent activity in real-time. Moreover, the agility of cloud deployment allows for rapid updates and feature implementation, ensuring adaptive defenses against evolving threats. Cloud platforms also foster collaboration and intelligence sharing among financial entities, strengthening collective efforts to thwart fraud.

As we move forward, the integration of advanced technologies in fraud prevention will become increasingly critical. Financial institutions that prioritize and invest in these technologies will be best positioned to navigate the complexities of the modern threat landscape, ensuring the security and integrity of their transactions.

M2P Fintech is ranked among the Top 500 high-growth companies in Asia-Pacific by Financial Times! This recognition reflects our significant revenue growth from 2019 to 2022. Click here to read more.

M2P participated in the 1st India – Philippines Tech Summit that happened in Manila recently. Sanjoy Bose, President of International Expansion – M2P, was a part of the panel discussion, and the panel shed insights on digital disruption and preparing for an AI-enabled future, highlighting the opportunities and challenges in the tech space.

At the 1st India – Philippines Summit, M2P Fintech and UNO Digital Bank entered a strategic partnership to launch a digital credit program in the Philippines. Together, we will offer digital credit services to enable consumption credit and drive meaningful impact in the region.

We are honored to have partnered with Universal Storefront Services Corporation (USSC) to launch digital payment channels (Visa Prepaid cards) in the Philippines. The agreement was signed at the 1st India – Philippines Tech Summit and this partnership will enable customers access to Visa card-based digital payment channels for domestic payments and remittances.

We recently organized Hack-AI-Thon 2024 for M2Peers, our annual marquee event that explored embedding GenAI into our products. In collaboration with Microsoft Azure, the event spanned 3 days and brought together 25 teams for brainstorming, ideation, and product development.