M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The global software market for Personal Finance Management (PFM) is set to skyrocket from USD 1.4 billion in 2022 to USD 4.2 billion by 2032.

The widespread adoption of smartphones and the internet has been a primary contributing factor to this phenomenal growth. Consumers are increasingly comfortable managing their finances on the go, and PFM apps cater to this convenience with features like real-time expense tracking, budgeting tools, and on-demand financial insights.

While PFM isn't a standalone business model, it becomes a powerful tool when integrated with various fintech solutions like budgeting apps, investment platforms, bill payment services, and open banking for a complete financial picture. These solutions provide better loan offers, investment options, and insurance products and unlock a wealth of benefits for both businesses and customers.

By integrating PFM, businesses can offer personalized financial products, while customers gain comprehensive financial views and proactive management. This fosters a win-win situation for both businesses and customers.

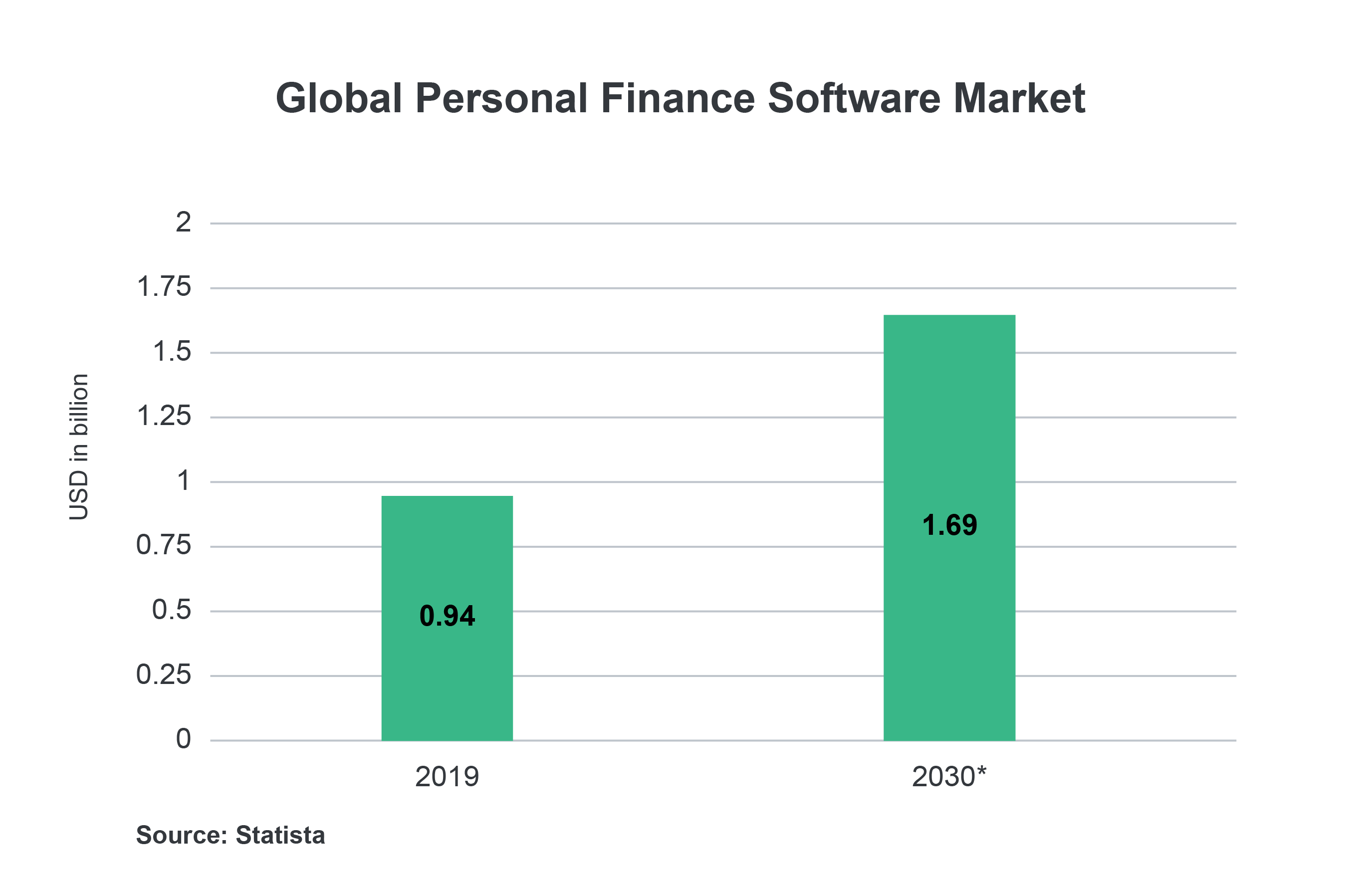

The global personal finance software industry is anticipated to grow to USD 1.69 billion by 2030.

Abhishek Arun, President, Business Development, M2P Fintech, partook in a dynamic panel discussion at the AWS Fintech Forum 2024 in Bengaluru. This event brought insight into ‘How Indian SAAS companies are revolutionizing the fintech landscape'.