M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

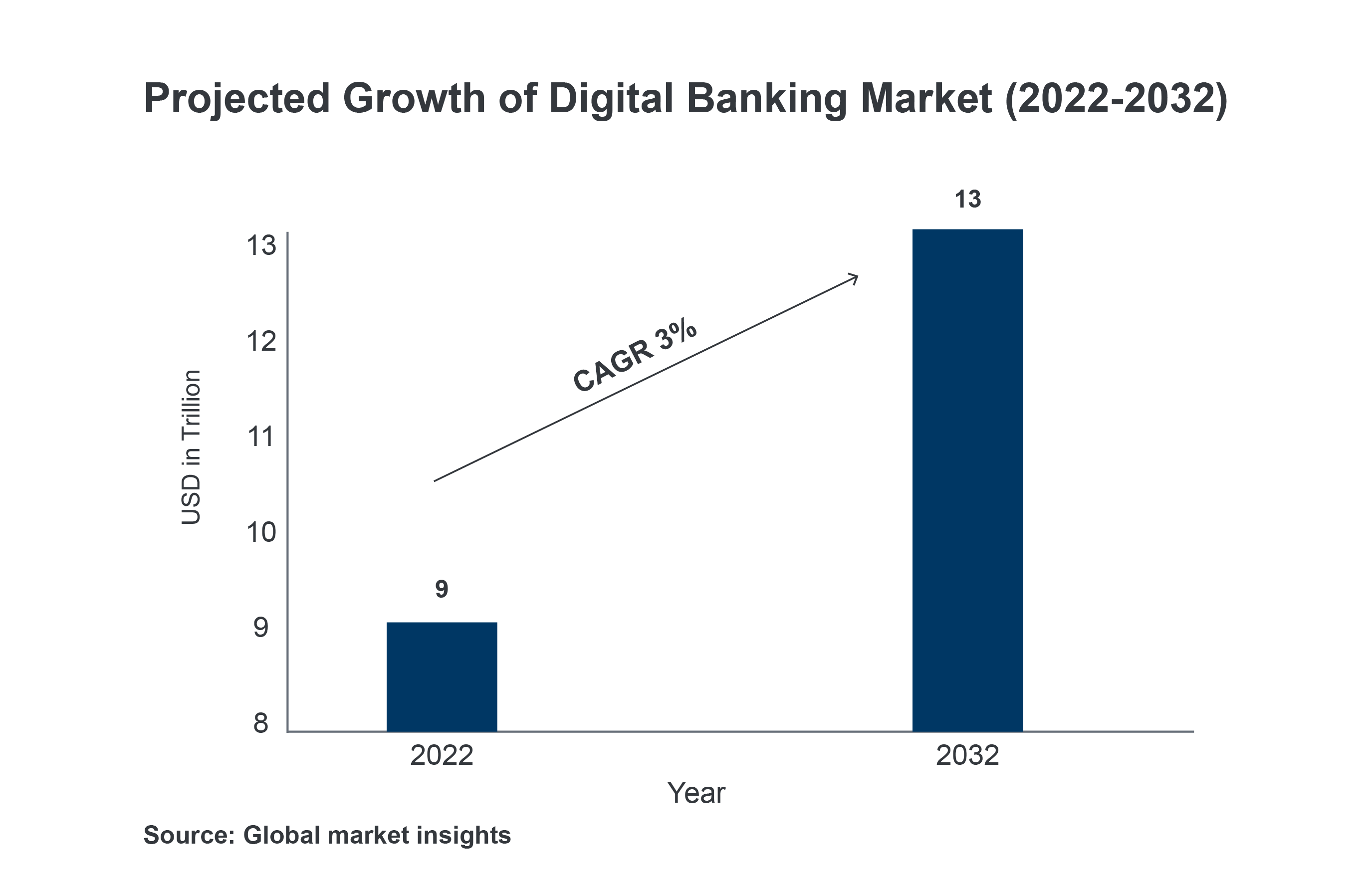

The digital banking market is booming, projected to reach USD 13 trillion by 2032, a significant jump from USD 9 trillion in 2022. Convenient mobile apps, real-time transactions, and personalized tools are driving this growth, enabling customers to bank anytime, anywhere.

But with this innovation comes an integral challenge: Ensuring cybersecurity.

Consumers in today's digital age demand secure and ethical data handling. A data breach or a failure to implement strong cybersecurity practices can erode trust and damage a bank's reputation, potentially leading to customer churn.

To remain competitive and foster customer trust, banks must prioritize strong, adoptable, and straightforward cybersecurity strategies.

Leverage cutting-edge AI that analyzes vast amounts of transaction data in real-time, identifying suspicious patterns and potential breaches before they happen.

Utilize advanced analytics to assess customer risk profiles, predict potential compliance breaches, and implement targeted mitigation strategies.

Automate repetitive tasks like Know Your Customer (KYC) and Anti-Money Laundering (AML) checks with Robotic Process Automation (RPA), boosting efficiency for faster onboarding and investigations.

Conduct regular security audits to identify and address vulnerabilities, ensuring a secure digital banking environment for both customers and stakeholders.

By taking a proactive approach to cybersecurity, banks can foster a digital banking environment built on trust and reliability. This not only minimizes the risk of cybersecurity threats but also empowers banks to navigate the inherent challenges of financial innovation.

The Global Digital Banking Market is projected to grow to USD 13 trillion by 2032, reflecting a CAGR of 3%.

M2P Fintech joins forces with Bureau to power secure and frictionless customer journeys. Leveraging combined expertise, we aim to monitor over 100 million transactions by year-end, fostering a more secure digital finance landscape. Click here to read more.