M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

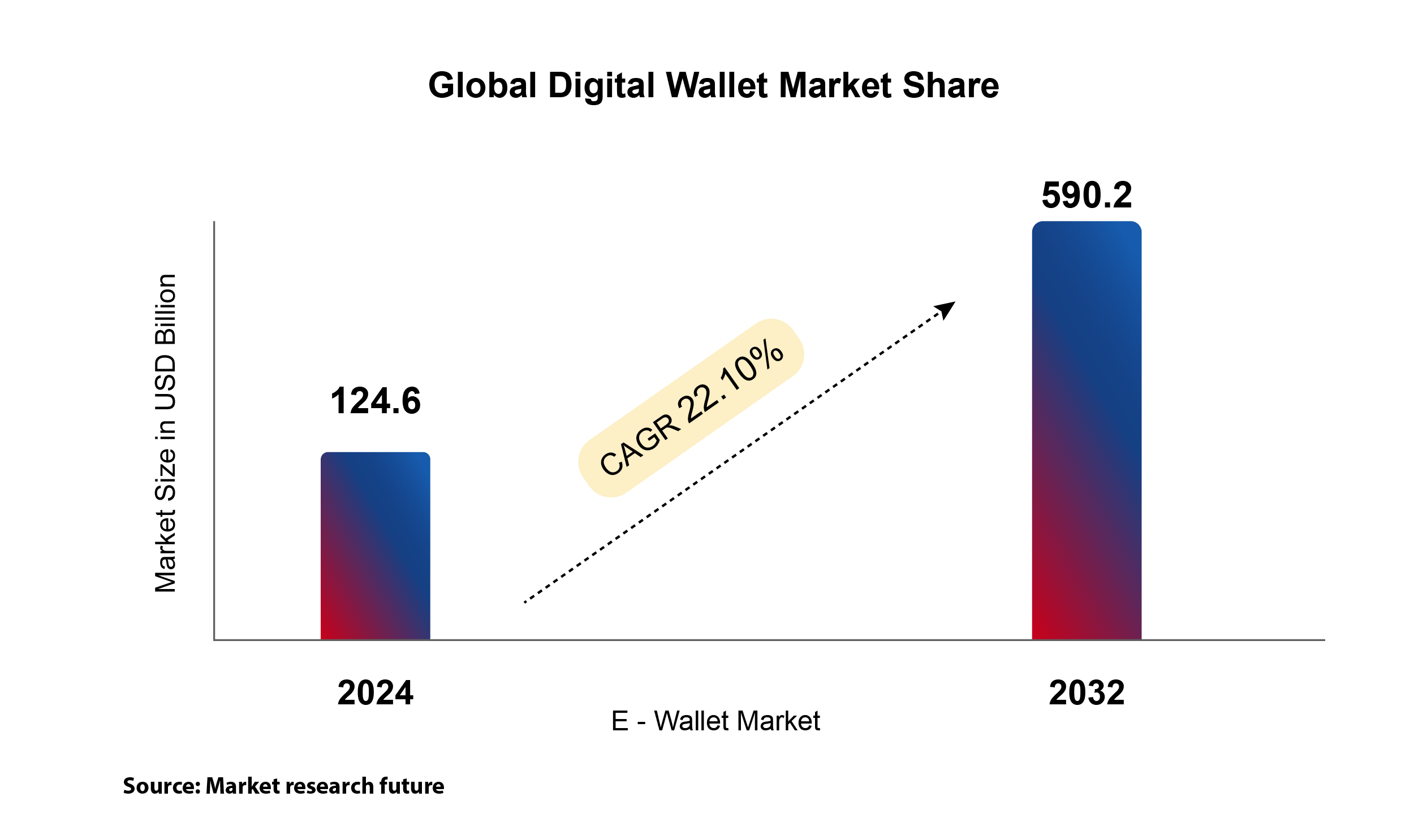

The global digital wallet market is on a powerful growth trajectory, projected to surge from USD 124.6 billion in 2024 to USD 590.2 billion by 2032. Today’s digital wallets go far beyond basic transactions. They are transforming how people transact, save, manage, and interact with financial services—driven by rapid advancements in mobile technology, artificial intelligence, open banking, and cybersecurity.

From biometric authentication and AI-powered financial insights to machine learning capabilities and seamless contactless payments, their functionality is expanding at an extraordinary pace, reshaping the future of how we engage with money.

Digital wallets are evolving into super apps, bundling payments, banking, investments, travel, shopping, and even messaging into a single platform. This all-in-one approach increases convenience and keeps users engaged with personalized offers and services.

Artificial intelligence is transforming digital wallets by enabling predictive analytics, personalized financial recommendations, and advanced fraud detection. Wallets now offer tailored budgeting, spending insights, and real-time alerts on suspicious activities, making them proactive financial companions rather than passive tools.

Contactless payments via NFC, QR codes, and virtual cards are now ubiquitous, enabling fast, secure transactions without physical contact. Innovations like voice-activated payments and in-car payment systems are further expanding wallet use cases beyond traditional retail.

Digital wallets now widely use biometric authentication, such as facial recognition, fingerprints, and even voice authentication, to provide foolproof security and a seamless user experience. This significantly reduces fraud and identity theft risks, making biometrics a gold standard for wallet security in 2025.

For financial institutions and consumers alike, these advancements signal a future where every transaction is smarter, safer, and more rewarding. As the capabilities of digital wallets continue to grow, it's undeniable that the way we interact with money is evolving—the future is already here.

Digital wallet market is on a meteoric rise!

https://www.marketresearchfuture.com/reports/e-wallet-market-4633

https://www.marketresearchfuture.com/reports/e-wallet-market-4633

At FIBE Berlin 2025, Co-founder Madhusudanan R participated in a panel discussion titled ‘Scaling Innovation: How Fintechs in India are Shaping the Future of Banking.’

Co-founder Madhusudanan R was featured in the Emerging Payments Association Asia’s in-depth report, ‘Digital Payments Revolution: India’s March to a Trillion.’