M2P Fintech

Fintech is evolving every day, and our newsletter is the perfect way to stay informed! Receive the latest fintech news, views, and insights directly in your inbox every fortnight—for FREE!

The fraud landscape has reached a new level of complexity, with over half of all attacks now involving AI-powered techniques such as deepfakes, synthetic identities, and automated scams. Last year alone, deepfake-related fraud attempts in the fintech sector surged by 700%, costing businesses billions annually. Traditional fraud detection methods, which are reliant on static rules and reactive measures, are no longer sufficient.

To counter this wave, fraud detection has undergone a fundamental shift from reactive damage control to proactive, intelligence-driven defense systems.

Let’s explore the key advancements reshaping fraud prevention and their impact on creating a safer digital ecosystem.

Modern fraud systems process billions of data points in milliseconds, analyzing behavior, location, and contextual signals to detect anomalies. Adaptive AI models evolve continuously, identifying fraud patterns in real time. Predictive analytics has enabled platforms to preempt risks like ad fraud, reducing related losses by up to 25%, as noted by Forrester in 2025. Unified platforms now integrate fraud, compliance, and risk in one AI-driven framework, streamlining response while ensuring regulatory alignment.

These systems don’t wait for warning signals, they anticipate them, slashing losses and boosting trust.

AI’s strength lies in its speed, but human judgment adds depth.

Despite the brilliance of AI, fraud detection is rarely black and white. Gray areas need more than algorithmic precision.

Institutions are increasingly integrating AI with analyst-friendly interfaces, enabling fraud experts to intervene, investigate, and interpret complex data points with contextual awareness.

This synergy not only improves accuracy but also accelerates decision-making in high-stakes scenarios where every second counts.

The convergence of predictive AI, adaptive learning, emerging technologies, and human expertise is setting a new standard in fraud prevention. By proactively identifying and mitigating threats, financial institutions can protect assets, maintain customer trust, and ensure the integrity of digital transactions. This comprehensive approach is vital in creating a secure and resilient digital ecosystem capable of withstanding the challenges posed by AI-driven fraud.

This revolution isn’t just about mitigating fraud; it’s about prevention, stopping threats before they ever take shape.

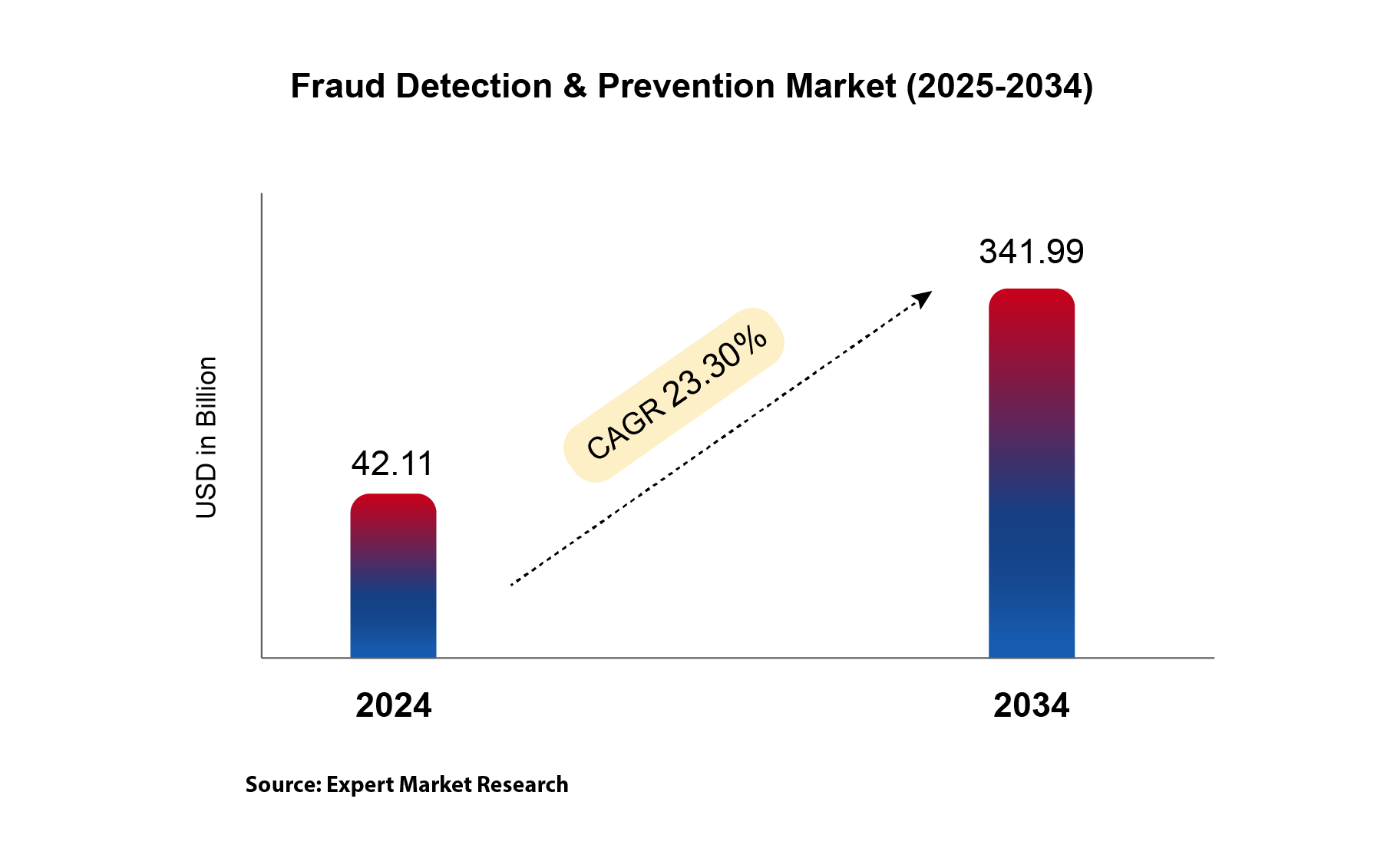

The fraud detection market will hit USD 342 billion by 2034.

Co-founder Madhusudanan R joined industry leaders at Money20/20 Asia for an open dialogue roundtable to discuss ‘India's Digital Payments Trajectory: Scaling to a Trillion.’

In an exclusive feature with IBS Intelligence, co-founder Madhusudanan R shared his vision on ‘The AI-Powered Playbook for FinTech Domination.’

Abhishek Arun, President of Platform Strategy & Commercialization, contributed to an insightful panel on the future of credit at Finnoways by Banking Frontiers & AWS.